The Basics of Private Placement Memorandums

Decoding the Essentials of PPMs in the Digital Age

Private Placement Memorandums (PPMs) have become a critical tool for businesses and investors looking to navigate the financial landscape effectively. These documents are pivotal to unregistered offerings, serving as a comprehensive guide to prospective investors about the details of the securities being offered. A PPM outlines everything an investor needs to know to make an informed decision. It covers essential aspects such as business operations, terms of the investment opportunity, and risk factors associated with the securities offered. Familiarizing yourself with these terms can be instrumental in understanding how to leverage private offerings strategically. For influencers, comprehending PPMs is more than just about legality; it's about recognizing potential business avenues. By grasping financial mechanisms such as private placements, influencers can explore diverse pathways to raise capital and fuel their initiatives. Furthermore, by understanding the nuances of placement memorandums, influencers can position themselves as informed, credible figures in the eyes of potential investors. The regulation surrounding securities laws ensures that investments, such as common stock in emerging brands or real estate ventures, adhere to legal and financial standards. Awareness of these regulations can empower influencers and their business plans to harness the benefits of private equity while effectively managing investment offerings. A well-structured PPM not only highlights the investment opportunity but also underscores the importance of compliance with legal services and laws regulations. The use of PPMs can also support influencers in mitigating risk by clearly communicating all necessary aspects to accredited investors and thereby building trust. For an in-depth look at the science behind active equity and its role in social media influence, check out this insightful piece. Understanding these financial tools can empower influencers to make strategic decisions that reflect on their brand and financial goals positively. Exploring these intricacies further can set the foundation for navigating financial opportunities effectively, combining the power of social media influence with informed investment strategies.Navigating Financial Opportunities as an Influencer

Exploring Financial Avenues for Influencers

Social media influencers are stepping beyond traditional income streams by tapping into private placement memorandums as an avenue to fund their ventures. Understanding how these financial opportunities unfold can empower influencers to expand their business operations. To begin with, influencers can leverage private offerings to secure funds without the need for public securities. This method allows them to maintain more control over their business strategies. Through a structured placement memorandum, an influencer can outline the investment terms, securities offered, and risk factors while keeping in compliance with securities laws. One key advantage is access to accredited investors. Influencers have the opportunity to present their business plan to such investors, who often look for unique investment opportunities within the digital realm. By showcasing an offering memorandum, influencers can effectively communicate their plans to prospective investors who are interested in supporting content-driven businesses. A private placement enables influencers to raise capital without diluting their brand identity. Such opportunities for raising funds are attractive because of their flexibility and the potential to secure substantial investments from private equity firms or real estate investors interested in digital assets. When scrutinizing these funding avenues, influencers must also navigate the complex legal landscape. Legal considerations are paramount, especially when handling an unregistered offering. It's essential for influencers to become familiar with the laws and regulations governing securities, as they play a crucial role in ensuring compliance and preventing legal pitfalls. In conclusion, private placement memorandums offer influencers a sophisticated method to explore financial growth while enabling them to maintain meaningful connections with their audiences. For those interested in deepening their understanding of such financial undertakings, resources exist to guide influencers through the nuances of managing and presenting an investment opportunity effectively.Legal Considerations for Influencers

Key Legal Aspects for Influencers Engaging in Private Placements

Engaging in private placements can be a lucrative avenue for influencers looking to raise capital through investment opportunities. However, there are important legal considerations that must be addressed to ensure compliance with securities laws and regulations. Firstly, it is vital for influencers to understand the nature of the private placement and the investment opportunity being offered. A private placement memorandum (PPM) often serves as the foundation for such offerings and outlines critical elements including the terms of the investment, risk factors, and the securities offered. For influencers, familiarizing themselves with the PPM can provide insights into the business operations and financial services of the company or fund. Moreover, influencers must be aware of the distinction between accredited investors and prospective investors, as private placements typically require investments from accredited individuals. Knowing who qualifies as an accredited investor is essential for crafting a legal and compliant offering. Legal counsel is highly recommended when dealing with securities offerings. An influencer's legal team’s expertise can guide through the maze of securities laws, ensuring that every aspect of the business plan aligns with the law. This is crucial because unregistered offerings could pose significant risks, including penalties or legal actions, if not conducted properly. In addition, influencers should consider liability concerns. The information shared in the offering memorandum must be accurate and complete to avoid misleading investors. It is important to transparently communicate all risk factors associated with the capital raise, as failure to do so may lead to legal complications. Another vital consideration is the law impacting financial transactions and investments, where influencers often face stringent regulations. Collaborations with professionals specializing in navigating the complexities of private fund regulations can provide a smoother engagement in the private placements while safeguarding against potential pitfalls. Overall, while private placements offer promising financial opportunities, they require careful legal examination to mitigate risks and adhere to legislation. Influencers need to be proactive in seeking legal advice and staying informed about evolving regulatory landscapes. For more information about navigating the complexities of private fund regulations, you can explore this detailed guide here. By adhering to these legal considerations, influencers can better position themselves to leverage investment opportunities effectively and compliantly.Case Studies: Influencers Who Benefited from Private Placements

Real-World Success Stories in Influencer Financing

In the dynamic sphere of social media influence, influencers have begun to explore varied avenues for raising capital, one of which includes private placement memorandums. As we delve into tangible examples where these financial tools have proven beneficial, a richer understanding of their potential emerges. Several social media influencers have successfully utilized private placements to diversify their income streams beyond traditional digital engagement methods. By leveraging offerings and investment strategies detailed in the placement memorandum, influencers have not only raised substantial funds but have also engaged with prospective investors interested in backing their ventures. One common thread in these case studies is the ability of influencers to articulate a compelling business plan within their offering memorandum. By clearly outlining the objectives, potential return on investment, and adhering strictly to securities laws, influencers have attracted accredited investors willing to partake in an unregistered offering. Successful influencers often collaborate with financial services professionals to craft a coherent strategy that mitigates risk factors while positioning their business operations for growth. This collaborative approach ensures that all legal and financial aspects adhere to relevant laws and regulations, thus safeguarding both the influencer and their investors. Moreover, these case studies demonstrate how influencers can maintain transparency, regularly updating their investors on the progression of business goals. This proactive communication not only strengthens investor relations but also sets a precedent for trust and credibility in the ever-evolving landscape of influencer-led investment opportunities. In conclusion, the experiences of those who have ventured into raising capital via private placements offer invaluable insights. It highlights the transformative potential of integrating financial products like private placement memorandums into the paradigm of social media influence, paving the way for smarter, sustainable growth strategies.Challenges and Risks Involved

Inherent Challenges and Recognized Risks

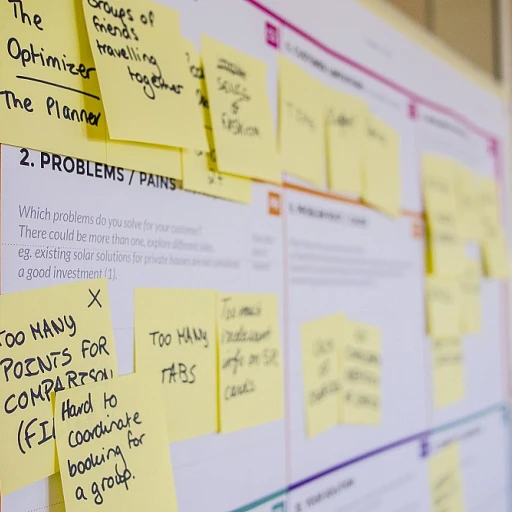

As influencers seek to navigate the financial landscape by exploring opportunities such as private placement memorandums (PPMs), they must be prepared to face several challenges and potential risks. A frequent hurdle involves understanding the complex legal and financial terms associated with PPMs, which are essential for offering securities to prospective investors. Influencers, who often have limited experience in business operations, might find these aspects daunting without proper legal and financial services to guide them.

Disclosure and Compliance

One major challenge is ensuring compliance with securities laws, both federal and state regulations, including those governing unregistered offerings. Non-compliance with these laws can lead to severe penalties and could jeopardize the influencer's prospects in raising capital. Therefore, accurate disclosure of risk factors becomes paramount, as it ensures that every prospective investor is aware of the potential downsides associated with the investment.

Securing Accredited Investors

The success of private offerings hinges significantly on the ability to attract accredited investors. Since a PPM is not publicly offered, influencers must effectively identify and secure these investors who meet the specific financial criteria laid out in the offering memorandum. This often necessitates a robust business plan that clearly outlines the investment opportunity and prospects for return on investment.

Market Volatility and Economic Factors

Accurate prediction of how market volatility and prevailing economic conditions might impact the value of the securities offered remains a challenge. Influencers need to anticipate these external factors when developing their business strategy, as they directly affect the attractiveness of their offerings.