Understanding Scientific Active Equity

Exploring the Core of Active Equity

The concept of active equity within social media influence is crucial for understanding how influencers operate in the realm of digital visibility and market dynamics. Just like in traditional finance, active equity for influencers involves using strategic insights to optimize their online portfolio, engage their audience, and drive high returns in terms of reach and engagement.

Active equity in social media influence can be likened to managing a complex portfolio of content where each post, collaboration, or campaign acts as an individual asset. Influencers employ various strategies, reminiscent of a portfolio manager in an equity fund, to maximize their influence and achieve a sustainable growth pattern.

The Intersection of Influence and Investment Strategies

A successful social media influencer understands the significance of investment strategies which involve carefully curated content and calculated risk-taking. This approach mirrors the processes seen in financial institutions where maximizing capital growth and optimizing performance are key objectives. Influencers must continuously refine their tactics, leveraging data analytics and performance metrics to gauge success and adapt to changing market dynamics.

Just as an investment manager navigates global equity markets or emerging markets to optimize returns, influencers must analyze their market and anticipate future trends to maintain and expand their influence. This involves understanding the role of algorithms and the impact of algorithm changes on reach and engagement, eventually improving their fund management skills in content creation.

Lorem Ipsum Dolor Sit Amet

For influencers, building authentic connections is synonymous with equity investment. Rather than focusing solely on short-term gains, influencers must envision long-term relationships that provide sustainable returns. This involves a deep understanding of audience behavior and the ability to connect with followers on a genuine level.

In the United States, where the business of social media influence is robust, the potential for growth is immense. By adopting an active approach, influencers can strategically position themselves to harness the benefits of first-mover advantage and navigate the complexities of market fluctuations akin to professionals managing mutual funds.

For further insights into how influencers can effectively utilize active equity strategies, our article on understanding private equity in the context of influencer marketing could provide a comprehensive guide for maximizing influence in social platforms.

The Role of Algorithms in Shaping Influence

The Influence of Algorithms on Social Media Dynamics

In the realm of social media, algorithms play a pivotal role in determining what content gets seen and by whom. These algorithms are akin to the strategies used in evergreen private equity, where long-term investment strategies are crafted to yield sustainable returns. Just as equity funds and portfolio managers use data-driven strategies to optimize performance, social media platforms leverage algorithms to enhance user engagement and content visibility.

Algorithms are designed to analyze vast amounts of data, much like the data analytics tools used in active equity management. They assess user behavior, preferences, and interactions to curate personalized content feeds. This process is similar to how investment strategies are tailored to meet the specific goals of investors, ensuring that the right content reaches the right audience at the right time.

Algorithmic Impact on Influencer Reach

For influencers, understanding these algorithms is crucial. Just as portfolio managers must navigate market fluctuations and emerging markets to maximize returns, influencers need to adapt to algorithm changes to maintain and grow their reach. The algorithms can significantly impact an influencer's visibility, much like how market dynamics affect the performance of equity funds.

Moreover, the algorithms' focus on engagement metrics means that influencers must create content that resonates with their audience, akin to how active equity strategies focus on high conviction investments to drive capital growth. This requires a deep understanding of audience preferences and the ability to pivot strategies as needed, similar to the agile approach required in portfolio management.

Balancing Algorithmic Influence with Authenticity

While algorithms are essential in shaping social media influence, maintaining authenticity remains paramount. Influencers, like managing directors overseeing diverse portfolios, must balance algorithmic demands with genuine connections. This balance is crucial for long-term success, as authenticity fosters trust and loyalty among followers, much like how consistent performance builds investor confidence in equity funds.

In conclusion, the role of algorithms in social media is analogous to the strategic processes in active equity management. Both require a nuanced understanding of data, a strategic approach to engagement, and a commitment to authenticity to achieve sustainable success.

Data Analytics: A Tool for Influencer Success

Leveraging Data for Strategic Advantage

In today's digital age, data analytics stands as a pivotal tool for influencers striving for success. With the vast volumes of information generated by social media platforms, analyzing this data effectively can greatly enhance an influencer's ability to make informed decisions, align with audiences, and optimize content strategies for better performance and returns.

Effective data analytics can reveal valuable insights into audience behavior, content engagement, and market trends. This is akin to the strategic processes used by portfolio managers in capital markets. As in the realm of equity investment, where managers scrutinize equities for high returns, influencers use analytics to identify the content that resonates most with their audience, optimizing their social media influence.

Take, for instance, how portfolio management strategies are built upon analyzing stocks, assessing risk, and predicting market performance. Similarly, influencers can delve into data analytics to tailor their strategies. By understanding which content garners the most engagement, influencers can craft highly engaging posts that align with audience interests, replicating the success seen in high-conviction investment strategies.

The role of data in both active equity funds and social media influence showcases how analytics can drive outcomes. The ability for influencers to gather, process, and interpret data means they possess a dynamic tool that not only augments their content efforts but also streamlines their investment in time and resources.

In conclusion, while the influx of data can appear overwhelming, mastering analytics draws parallels with successful investment management. As influencers implement strategic data-driven decisions, they pave the path towards sustainable success amidst the evolving landscape of social media influence. Embracing this analytical approach is not unlike adopting an active equities stance within the market—forward-thinking, adaptable, and focused on long-term growth.

Building Authentic Connections Through Equity

Building Genuine Ties through Equity

In today's dynamic landscape of social media influence, establishing authentic connections is paramount. Authenticity doesn't merely involve transparent communication but extends to leveraging equity in meaningful ways. Active equity, when employed strategically, can fortify these connections, creating long-term trust and engagement.

Active equity, akin to BlackRock's approach, intertwines with social media by ensuring that the influencers manage their portfolios of followers with the same vigilance as they would for financial equities. This involves a deep understanding of the audience's interests, much like an investment manager tailors a portfolio to meet investors' needs.

Much like an equity fund manager develops a high-conviction investment strategy, influencers today are tasked with crafting content that aligns with both their personal brand and audience interests. This alignment is not dissimilar to portfolio management in the investment world, where a diversified portfolio is designed to balance risk and maximize returns. Influencers must similarly align their content across different platforms to maintain their reach and engagement.

Equity funds, particularly those managed by global entities like BlackRock, employ active strategies to deliver performance that exceeds market benchmarks. Similarly, influencers must be proactive in analyzing data and trends, understanding what resonates globally with their audience, thereby achieving growth and sustained influence.

While the financial world often grapples with the challenge of measuring success predominantly through returns, social media influence likewise poses the challenge of measuring genuine engagement. Here, data becomes a powerful tool, as seen with data analytics in understanding performance metrics, enabling influencers to assess what content yields the best return on engagement.

In conclusion, the paradigm of using active equity as a framework in the social media sphere is essential for building authentic, impactful connections. Just as BlackRock actively manages its funds through strategic portfolio construction, influencers must diligently manage their social media presence to achieve long-term success and sustainability in an ever-evolving digital market.

Challenges in Measuring Influence

Complexities in Quantifying Real Influence

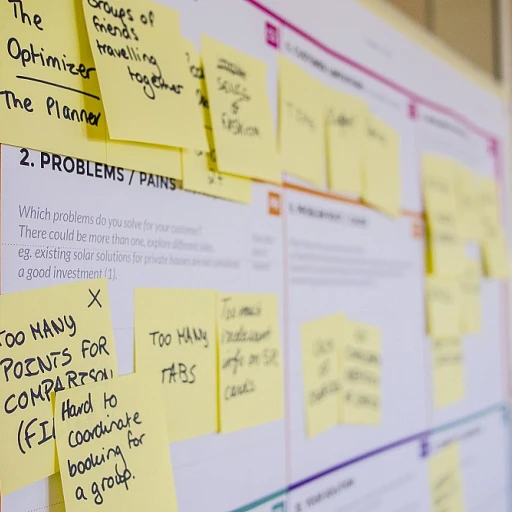

Ensuring precise measurement of social media influence remains a significant hurdle within the sphere of active equity. As platforms evolve with intricate algorithms evolving, such as those managed by renowned firms, measuring influence becomes both a science and an art. While data analytics can be a tool for influencer success, the unpredictable nature of emerging markets adds an additional layer of complexity. Factors such as shifting market dynamics and diverse investment strategies play into this challenge. Active investors, often guided by seasoned managing directors, must navigate the fluctuations inherent to global markets and equity funds. The unpredictable nature of stock performance in emerging markets further complicates these dynamics. Moreover, understanding active equities in this landscape involves balancing quantitative data and qualitative insights. This balance is particularly challenging in the United States, where global equity markets intersect with local trends, making the management of active portfolios both an opportunity and a risk. Investment strategies hinge on high conviction and long-term vision. Yet, influencers must manage the influence portfolio much like a portfolio manager does with equity funds—analyzing risk and potential returns, while striving for sustainable capital growth. Collaborating with third-party analytics providers can enhance performance insights, helping identify opportunities in active equity and traditional equity funds alike. However, the challenge lies in adjusting strategies to keep pace with market shifts without compromising on authenticity—a cornerstone in building equity. Navigating these waters requires understanding the investment process deeply, akin to managing a mutual fund where strategies are regularly adapted. As portfolios expand and the insights extend globally, influencers must continuously learn and adapt, aligning their influence management akin to a portfolio construction focusing on long-term returns.Future Trends in Social Media Influence

Emerging Trends Shaping Tomorrow's Social Media Landscape

The social media landscape is ever-changing, influenced by technological advancements and evolving user expectations. As platforms continue to innovate, several trends are set to redefine how influence is perceived and leveraged.- Algorithmic Evolution: The role of algorithms is crucial and continuously evolves. As data sets grow more advanced, prediction models become more accurate, offering new ways for equity and investment opportunities on social media to thrive. These enhanced algorithms could offer deeper insights into performance metrics, enabling more efficient active equity management.

- Data-Driven Decision Making: With the increased focus on equity and investment strategies, data analytics will become indispensable. Investors leveraging data analytics can expect smarter portfolio management, optimizing global equity returns by identifying high conviction stocks and tailoring investment strategies.

- Equity and Fund Integration: As the boundaries between social influence and equity investment blur, stakeholders like BlackRock and other global firms may begin embedding active equities into their social media strategies. This integration could potentially reshape portfolio construction, embodying a sophisticated blend of market insights and influencer collaboration.

- Authentic Engagement: Building genuine connections will be more important than ever. As equity funds aim for long-term success in emerging markets, fostering authentic engagement with audiences can enhance portfolio performance and advocacy at a global scale.

- Risk Management: The introduction of innovative ETFs and mutual funds dedicated to social influencer portfolios could be on the horizon. These funds would offer investors diversified exposure, balancing risk while capitalizing on influencer-driven market trends.