The Intersection of Investment Firms and Social Media

The Financial Landscape of Social Media Influence

In recent years, the synergy between investment firms and social media has created a dynamic landscape where both gain substantial traction from each other's strengths. Investment firms, particularly private equity and venture capital entities, are significantly impacting the way influencers operate within the digital world. The influx of capital from these fund managers is not just reshaping the financial backdrop for influencers but is also defining new strategic pathways for growth.

Investment firms, including institutional investors and family offices, recognize the potential high growth of influencers, especially in realms like lifestyle and consumer technology. By incorporating their capital and strategic insights, they can elevate not only the financial status of influencers but also improve their market reach significantly. As influencers become more embedded in the portfolios of these firms, such as equity funds, this integration also opens doors for broader strategic initiatives including real estate investments and tech partnerships.

Understanding this intricate relationship is crucial for influencers aiming to leverage their online presence for maximum impact. To gain a deeper understanding of how these intersections affect broader business dealings, such as portfolio companies, influencers can explore how investment firms manage and grow their assets. In doing so, they can better position themselves as attractive partners for investment companies.

Financial Backing: A Game Changer for Influencers

Powerful Financial Support: Transforming the Influencer Landscape

The influx of financial backing from investment firms has become a transformative force in the world of social media influence. With the massive capital reserves that private equity firms, venture capitalists, and hedge funds bring, the landscape for influencers is rapidly evolving. This financial power is not just about providing funds; it is about reshaping the very dynamics of how influencers operate. Firstly, investment firms provide influencers with access to resources that can significantly accelerate their growth. Whether it's through investing in better content creation tools, expanded marketing campaigns, or strategic business partnerships, influencers are now capable of reaching larger audiences and enhancing their market presence. With capital backing from high-profile companies, influencers have the opportunity to venture into new markets, including real estate investments and other untapped sectors. Furthermore, collaborations with these firms offer a pathway to enhance credibility and authority. When an influencer is associated with institutional investors or publicly traded companies, it can elevate their status in the eyes of audiences and potential partners. Such collaborations become a badge of legitimacy, signaling to followers and brands alike that the influencer is not only popular but also has strong business acumen. However, while these financial opportunities are game-changing, they also bring complexities. Investment firms, driven by returns and profitability, may impose certain expectations and performance metrics on influencers. This creates a pressure not only to maintain audience engagement but also to meet financial goals and demonstrate a return on investment. As influencers navigate these waters, they must balance creative independence with institutional objectives. It's crucial for influencers to fully understand the implications of partnering with investment firms. Financial backing is an engine for growth, but it must be approached strategically. For those interested in deeper insights on managing such confluences, "Understanding DPI in Private Equity: A Guide for Influencers" provides valuable guidance. To thrive in this highly competitive and rapidly evolving landscape, influencers must integrate financial tools within their broader strategy, ensuring alignment with their brand identity and audience needs.Challenges Faced by Influencers in a Corporate-Driven Environment

Corporate Influence on Social Media Presence

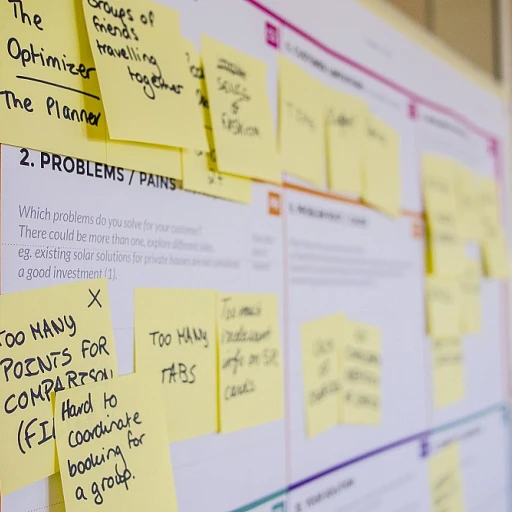

The dynamic relationship between influencers and the corporate sector, particularly private equity and real estate firms, presents unique challenges in today's market. Private equity investors and institutional investors in these sectors bring financial clout and strategic support to influencers seeking capital growth. However, navigating this environment is not without its hurdles. Influencers often find themselves balancing their creative autonomy and the demands of equity fund-driven goals. Equity funds, housing firms, and asset class companies may push for content that aligns with their interests to maximize their returns. This shift in priorities can lead influencers to question how they maintain authenticity while satisfying their investment backers. Additionally, influencers who engage with publicly traded companies or private real estate investment trusts need to be acutely aware of the rules and regulations. These include staying compliant with financial disclosures, understanding the expectations of institutional portfolio management, and aligning with the various asset and equity management strategies these high growth firms implement. Furthermore, influencers face the critical task of sustaining their presence amid the growing competition. With the influx of private equity investing into the influencer ecosystem, market saturation can diminish their visibility, necessitating the use of clever strategies to differentiate themselves. In essence, careful strategizing, balanced collaborations, and consistent messaging become crucial for influencers as they navigate the challenges of operating within a corporate-driven environment. The stakes are high, and understanding how investments impact their platforms is a must for those aiming to succeed in this complex landscape. For more on how influencers are reshaping industries, explore how influencers are shaping our world.The Role of Data and Analytics in Influencer Success

Leveraging Data for Strategic Growth

In the realm of social media influence, data and analytics have become indispensable tools for influencers seeking to maximize their impact. Investment firms, particularly those involved in private equity and venture capital, recognize the potential of data-driven strategies to enhance influencer success. By analyzing audience demographics, engagement metrics, and market trends, these firms can provide influencers with insights that drive strategic growth.

For influencers, understanding the nuances of data analytics is crucial. It allows them to tailor their content to meet the preferences of their audience, thereby increasing engagement and expanding their reach. Investment firms often employ sophisticated analytics tools to track performance metrics, offering influencers a competitive edge in the crowded social media landscape.

Data-Driven Decision Making

Investment firms bring a wealth of experience in data-driven decision making, a skill that is increasingly valuable in the digital age. By collaborating with these firms, influencers can access a treasure trove of data that informs their content strategies. This partnership enables influencers to make informed decisions about content creation, timing, and platform selection, ultimately enhancing their market presence.

Moreover, the integration of data analytics into influencer strategies aligns with the broader trend of institutional investors seeking high-growth opportunities in the digital space. As these investors pour capital into social media ventures, the emphasis on data becomes even more pronounced, driving the evolution of influencer marketing.

Challenges and Opportunities

While the use of data and analytics presents significant opportunities, it also poses challenges. Influencers must navigate the complexities of data privacy and ethical considerations, ensuring that their strategies align with industry standards. Investment firms play a crucial role in guiding influencers through these challenges, providing the expertise needed to balance data-driven insights with ethical practices.

As the relationship between influencers and investment firms continues to evolve, the role of data and analytics will undoubtedly expand. By embracing these tools, influencers can not only enhance their current strategies but also position themselves for future success in an ever-changing market.

Ethical Considerations in Influencer Partnerships

Critical Moral Compass in Collaborations

In the ever-evolving world of social media influence, partnerships between influencers and investment firms have become increasingly prevalent. However, these collaborations often present a unique set of ethical challenges that both parties must navigate with caution. First and foremost, the infusion of capital from private equity and venture capital firms can transform an influencer's reach and engagement. These financial backings allow influencers to access resources that enable them to produce high-quality content and engage with their audiences more effectively. Despite these benefits, the significant investment of funds can potentially pressure influencers to prioritize commercial gains over organic content creation. Transparency in partnerships is critical. When influencers partner with publicly traded companies or private real estate funds, their audience has a right to know the nature of these collaborations. Explicit disclosures about sponsorships and financial interests are not just a courtesy; they are essential to maintaining trust with followers. Moreover, regulatory frameworks often mandate such transparency to safeguard the interests of both consumers and institutional investors. Furthermore, the intersection of branding and personal values can be delicate. For instance, an influencer with an eco-friendly persona might face ethical dilemmas when approached by a firm involved in real estate investment that does not align with their values. In such cases, influencers need to weigh the ethical implications of capital partnerships against the allure of high growth potential and asset class diversification. Lastly, there's a moral obligation to consider the societal impact of promoting specific products or investment opportunities, especially those related to housing and family homes. Influencers should strive to ensure that their endorsements contribute positively to their community, without inadvertently promoting market instability or housing bubbles. By recognizing these ethical considerations, influencers and investment firms can forge partnerships that align with shared values, ensuring the sustainability and integrity of the digital market space. The future of social media influence will likely see a more profound emphasis on ethical standards as audience awareness and expectations continue to rise.Future Trends: The Evolving Relationship Between Influencers and Investment Firms

Emerging Dynamics in Partnerships and Collaborations

The landscape of social media influence is shifting, as influencers increasingly find themselves intertwined with investment firms. This evolving relationship is propelled by a growing desire from both parties to harness the mutual benefits of collaboration. Looking ahead, several trends mark the future of this dynamic interplay.- Diverse Investment Opportunities: Influencers are exploring new territories with the backing of private equity, venture capital, and real estate investment ventures. The infusion of capital funds from these entities allows influencers to diversify their income streams beyond traditional brand partnerships. This diversification includes investments in single-family homes, publicly traded companies, and even institutional asset classes.

- Increased Institutional Participation: Institutional investors are showing heightened interest in tapping the potential of social media influencers. Asset management firms and equity funds are devising innovative strategies to include influencer-centric investments in their portfolios, recognizing the substantial market influence these digital personalities yield.

- Enhanced Data Utilization: With the rise of sophisticated data analytics, influencers and investment firms alike are leveraging available information to optimize collaborations. This data-driven approach aids in identifying high growth potential markets and streamlining estate investment strategies that align with influencer audiences.

- Ethical and Sustainable Options: As awareness around ethical considerations grows, influencers and investment companies are developing strategies to ensure that investments and collaborations align with socially responsible ideals. Influencers are held accountable in promoting transparency and sustainability alongside their investment partners.

- Strategic Long-term Alliances: Long-term partnerships between influencers and equity firms suggest a synergistic future. Tailored collaborations open doors for influencers to co-create products, invest in promising startups, or even co-manage real estate funds. These alliances foster a balance between creative pursuits and corporate objectives.