The Intersection of Evergreen Private Equity and Social Media

The Convergence of Evergreen Investments and Social Media Dynamics

The landscape of social media influence is ever-evolving, and influencers are continually seeking sustainable strategies to maintain their market presence. One intriguing approach gaining traction is the integration of evergreen private equity into the influencer space. This intersection not only offers longevity in financial support but also presents a dynamic avenue for growth and stability. Investors and equity funds, particularly those that embrace the evergreen model, present a unique opportunity for influencers seeking long-term partnerships. These are open-ended funds that don’t have a set expiration, allowing for continuous capital infusion. These funds are managed by experienced fund managers who focus on robust portfolio performance and asset management. By tapping into the resources of closed funds and private equity companies, influencers can benefit from tailored fund management that adjusts to their unique business models. This provides them with a competitive edge within private markets, unlike traditional equity funds. With this merging of worlds, influencers gain not just monetary backing but also expert services that optimize their brand's influence over time. Moreover, the open-ended nature of evergreen funds means they align well with the asset class demanded by social media equity and can better support the unique demands of influencer markets. For individual investors or large equity fund managers, investing in the burgeoning field of social media influencers could represent a notable opportunity to diversify their portfolios and gain access to the fast-paced digital sphere. For influencers, examining the advantages of evergreen capital and understanding how to access private opportunities in this space is crucial. More information on how venture capitalists source deals and insights on influencer partnerships can be found in this link. Finding innovative strategies to attract these investments will be pivotal for influencers looking to strengthen their long-term positioning in the market.Why Influencers Should Consider Evergreen Private Equity

Exploring the Benefits of Evergreen Private Equity for Influencers

In the dynamic world of social media, influencers are constantly seeking sustainable growth and financial stability. Evergreen private equity presents a unique opportunity for influencers to achieve these goals. Unlike traditional closed funds, evergreen funds offer a continuous investment model, allowing influencers to benefit from long-term capital without the pressure of short-term exits.

One of the key advantages of evergreen private equity is its ability to provide influencers with access to a diverse portfolio of assets. This diversification can help mitigate risks associated with market volatility, ensuring a more stable income stream. Additionally, evergreen funds are managed by experienced fund managers who possess deep insights into private markets, enhancing the overall performance of the investment.

For influencers, partnering with evergreen equity funds can also mean access to a network of private companies and individual investors. This network can open doors to new business opportunities and collaborations, further expanding an influencer's reach and impact. Moreover, the long-term nature of evergreen investments aligns well with the evolving landscape of social media, where trends and platforms are constantly changing.

Understanding the role of private equity recruiters in social media influence can also be beneficial for influencers looking to navigate the complexities of securing evergreen investments. These professionals can provide valuable guidance and support, helping influencers connect with the right investors and fund managers.

In summary, evergreen private equity offers influencers a strategic avenue for sustainable growth, financial stability, and expanded opportunities. By leveraging the expertise of fund managers and the diverse asset class of evergreen funds, influencers can position themselves for long-term success in the ever-evolving social media landscape.

Challenges Faced by Influencers in Securing Evergreen Investments

Barriers to Securing Evergreen Equity for Influencers

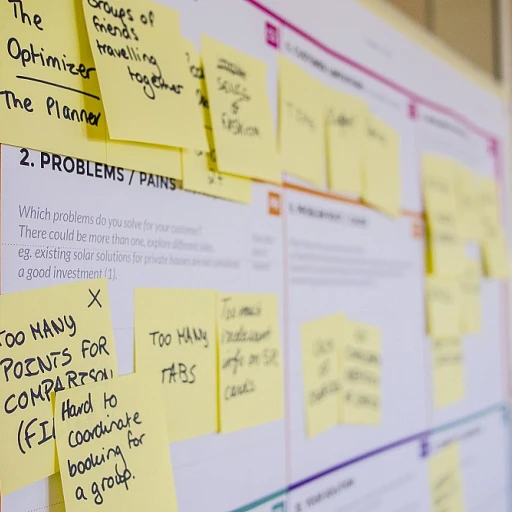

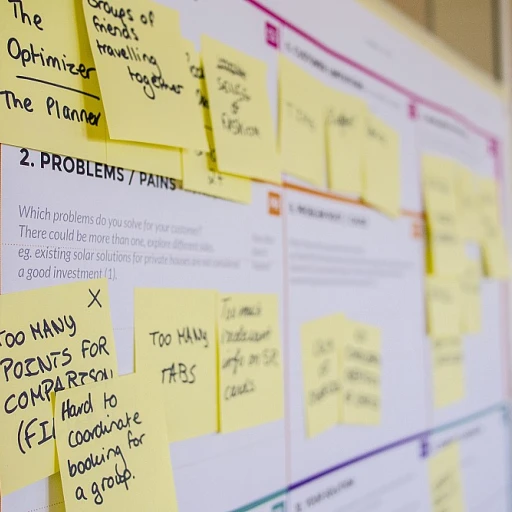

Navigating the world of evergreen private equity can be a daunting task for influencers who typically operate as sole entities rather than traditional businesses. Securing such investments requires a comprehensive understanding of the intricacies of fund management, investment strategies, and private equity landscapes, presenting several key challenges:- Understanding Fund Dynamics: Influencers must get to grips with how evergreen funds differ from other investment types, such as closed funds. These evergreen funds are open-ended, providing continuous investment opportunities; however, they require a long-term commitment that can be complex to manage without professional guidance.

- Evaluating Business Performance: Investors prioritizing evergreen capital need confidence that the influencers' business models have sustainable market potential. Demonstrating consistent performance and growth in social media influence is pivotal but often something individual influencers find difficult without the assistance of financial analysts.

- Access to Capital: Many influencers may lack the same access to private capital markets or equity funds as established corporate entities. This creates a gap in opportunities mainly because evergreen investors often target businesses with proven track records in generating returns.

- Developing Investment Proposals: Crafting compelling proposals that appeal to private equity firms requires an in-depth understanding of equity fund expectations and portfolio management strategies. Influencers often need assistance translating their brand influence into metrics that align with the business models that evergreen funds prioritize.

Strategies for Attracting Evergreen Private Equity

Strategies to Appeal to Evergreen Private Equity Investors

For influencers seeking to obtain evergreen capital, it's crucial to understand how to strategically position oneself to attract these enduring investments. Below are some practical strategies that can elevate an influencer's appeal to potential investors.- Demonstrate consistent performance: Investors in evergreen funds are drawn to influencers who show a steady track record of high-quality content and consistent audience engagement. Highlighting past successes and sustained growth in follower numbers or engagement rates can aid in showcasing reliability.

- Craft a compelling narrative: It's essential for influencers to articulate a clear, compelling business narrative that aligns with the long-term interests of evergreen private equity funds. This narrative should underscore how your brand offers unique value within the private markets and illustrate potential for sustained growth.

- Present a robust portfolio: Just as with any other business seeking investment, having a strong portfolio is vital. Displaying a diverse range of collaborations with private companies can demonstrate versatility and an ability to thrive across various markets.

- Showcase long-term vision: Influencers should emphasize their long-term market strategies and plans for scaling their influence. An evergreen investor is more likely to commit to influencers who have a sustainable business plan and a vision for future growth.

- Engage with fund managers and investors: Building relationships in the private equity space is fundamental. Networking with fund managers and potential investors can provide insights into the latest changes in equity fund management and trends within evergreen funds.