The Intersection of Finance and Social Media

The Convergence of Finance and Digital Platforms

The evolving landscape of social media has transformed how finance-related content is communicated and consumed by a global audience. Platforms such as Twitter, LinkedIn, and Instagram serve as dynamic conduits for disseminating information about investment strategies, global investments, and financial market trends. As the influence of digital platforms grows, the need for expertise in effectively communicating complex financial concepts becomes more critical. At the heart of this convergence is the investment committee, a key player in driving policy and strategy within asset management firms. The investment committee, often comprising experienced directors and chief investment officers, plays a pivotal role in steering decisions related to asset allocation, private equity, and global head positions. Their insights on market risks and opportunities shape investment strategies, making their collaboration with social media influencers vital. Influencers are tasked with the challenge of interpreting and communicating the views of these committees to a broader audience. By breaking down complex ideas through engaging content, stakeholders can better understand the implications of multi-asset investments and the nuanced aspects of fixed income and real estate. For influencers, understanding the composition and guidance of an investment committee is crucial. It involves appreciating their long-term visions and how they navigate the diverse asset classes. As such, influencers need to be well-versed in financial jargon and concepts to maintain credibility with their followers. To delve further into how specific financial mechanisms operate within social media, exploring the concept of a capital call provides deep insights into investment operations and communication dynamics. The intersection of finance and social media is poised for continued evolution, offering both opportunities and challenges for those engaged in this dynamic space. The growing influence of technology in reshaping communication strategies highlights the importance of aligning financial content with changing audience preferences and technological advancements.Influencer Marketing: A Financial Perspective

A Glimpse into Financial Realms

Influencer marketing has revolutionized the dynamics of sectors all over the world, and the financial sphere is no exception. It’s a space where influencers have the potential to wield considerable sway over private equity, private investments, and global markets. The unique ability to reach millions has granted influencers a potent voice in shaping investment strategies and asset allocation, traditionally managed by seasoned professionals in a global investment committee.The Meeting Point of Influence and Finance

From global investments to fixed income, influencers have reshaped how financial products and services are marketed. The narrative they create can drive investors' appetites, especially when endorsed by authoritative figures who regularly engage with their audience on social media platforms. Influencers help demystify complex financial products, translating technical jargon into relatable content for a broader audience.Understanding the Financial Echoes of Influence

With their extensive reach, influencers can affect the perception of investment strategies and even the outcome of asset management decisions. They offer insight into multi-asset strategies, real estate, and private equity, and they may reflect a view of a global head or a chief investment officer on current markets. This often leads to a more informed audience that is prepared to make sound investment choices. Is your curiosity piqued to explore this intersection of finance and influence further? Dive deeper into understanding the impact of evergreen funds on social media influence here.Challenges Faced by Influencers in Financial Decision-Making

Overcoming Financial Hurdles in Decision-Making

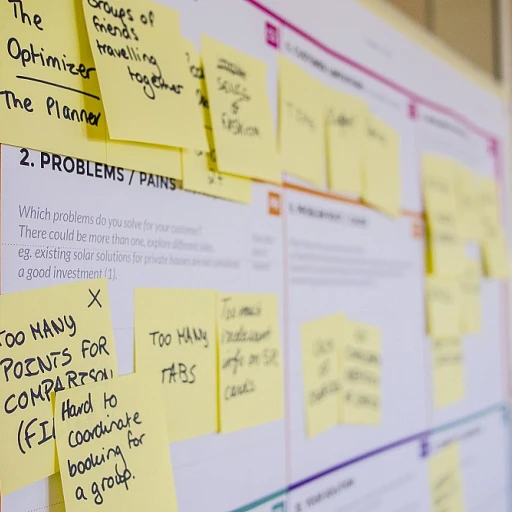

In the world of social media influence, aligning financial decisions with investment committees can be daunting. Influencers often encounter a web of complexities that require a thorough understanding of private equity and global investments. These challenges are not merely financial—they involve strategic asset allocation and risk management that demand expertise and trust. Navigating the landscape of asset classes and investment strategy is no small feat, especially when influencers are expected to offer credible insights. For influencers, establishing authority in these circles can hinge on their ability to present a well-rounded view biography of their ventures. Furthermore, participation in such high-stakes financial discussions necessitates a familiarity with the intricacies of management, policy, and board decisions.- Communication with Experts: Influencers might find themselves needing to engage with senior roles within organizations, such as managing directors or the chief investment officer. Comprehending the board's view on multi-asset investments or consulting with the global head of operations can be crucial.

- Risk Assessment: Unlike traditional content creation, the inclusion of financial perspectives requires a sophisticated understanding of risk management concerning global markets, ann arbor initiatives, and long-term policies.

- Balancing Expertise: Influencers must balance creative storytelling with factual accuracy, particularly when discussing real estate, fixed income, and private equity. Leveraging sources like the potential of university ventures in social media influence can enhance the trustworthiness of their content.

Strategies for Influencers to Engage with Investment Committees

Collaborative Strategies to Bridge Influencers and Investment Committees

In the increasingly intertwined worlds of finance and social media, influencers serve as vital conduits of information, wielding the power to sway public opinion. Yet, navigating this complex landscape requires deft strategies to effectively engage with global investments committees, which play a crucial role in managing financial decisions and policies. One of the foremost strategies is the development of a comprehensive understanding of the investment landscape. This involves influencing spheres such as private equity, real estate, and fixed income markets. By aligning content with these sectors, influencers can offer insights that resonate with the asset management objectives of investment boards. ### Building Trust with Investment Decision-Makers For influencers to establish credibility, it is vital to differentiate themselves by providing well-researched views and ideally, pre-empt potential questions investment officers might pose. Engaging with intricate financial topics, such as asset allocation or chief investment strategies, requires not just superficial understanding but depth, supported by credible data and analysis. Furthermore, influencers should aim to connect personally with key figures such as the head or managing director of a group. Insight into the decision-makers’ strategic goals and priorities will allow influencers to tailor content effectively, making information relevant and actionable for a specific audience. ### Leveraging Multi-Asset Expertise Gaining a broad understanding across various asset classes is essential. Influencers should focus on multi-asset investment strategies that highlight their adaptability and expertise in shifting market currents. Presenting content with a focus on risk management and long-term growth can draw attention from investment committees looking for sustainable partnerships. To further cement their authority, influencers might seek opportunities for real-time engagements, such as webinars or panels, featuring the head of global investment committees. This openness to dialogue reflects a commitment to transparency and ongoing learning. ### Policy and Communication Alignment Effective communication strategies are indispensable. Influencers must ensure that their messaging aligns with the overarching communication policies of the investment group they seek to engage with. Developing a nuanced understanding of committee-specific policies and tailoring content to address these can create a symbiotic relationship conducive to mutual growth. Ultimately, leveraging digital platforms to communicate these insights can significantly enhance the perceived value of influencers in a global context. As influencers chart their course in the investment domain, their ability to foster relationships with investments committees could set the stage for more effective collaborations and opportunities in the world of finance. For more insights, readers can explore how investment firms influence social media.Case Studies: Successful Influencer Collaborations with Investment Committees

Showcasing Impactful Collaborations

The integration of influencers with investment committees can lead to mutually beneficial relationships, where influencers bring fresh perspectives to traditional financial decision-making. Let's delve into some compelling case studies that highlight successful collaborations between influencers and investment committees.- Leveraging Expertise Across Asset Classes: In the dynamic world of asset management, influencers have worked alongside investment committees to evaluate global investments spanning various asset classes. From real estate to fixed income, these partnerships have allowed for a diversity of viewpoints, enhancing the understanding of market trends and long-term strategies. This collaborative approach not only supports robust asset allocation but also provides influencers with a deeper grasp of investment strategies.

- Contributions to Policy Development: Influencers possessing a strong biography in financial markets have been pivotal in shaping policy decisions within global investment committees (GIC). These influencers bring unique insights into risk management, crucial for navigating the complexities of modern markets. The collaboration often results in more comprehensive investment policies that align with contemporary trends.

- Private Equity Insights: In the realm of private equity, influencers have successfully collaborated with the managing director and head investment teams. These influencers, often with a background in private investments and asset management, bring a nuanced view of market conditions. By engaging with influencers, committees have been able to stay abreast of market dynamics and innovate their investment strategies in global markets.

- Enhancing Communication Strategies: Chief investment officers and directors frequently collaborate with influencers to communicate investment strategies effectively to a wider audience. This synergy ensures that complex financial concepts are conveyed in a relatable manner, fostering trust and transparency among investors.

- Direct Impact on Equity Strategies: Influencers often participate in board meetings as external advisors, providing a fresh perspective on equity strategies. By engaging influencers with diverse views, investment committees can refine their global investment approaches, ensuring relevance in diverse markets.

Future Trends: The Evolving Role of Investment Committees in Social Media

Anticipating the Future of Investment Committees in Social Media

The landscape of social media influence is rapidly evolving, and investment committees are increasingly recognizing the potential of this dynamic platform. As influencers continue to shape public opinion and market trends, the role of investment committees in social media is expected to grow more significant. Here are some key trends to watch:

- Integration of Social Media Analytics: Investment committees are likely to incorporate social media analytics into their decision-making processes. By analyzing trends and sentiments, committees can gain insights into market movements and consumer behavior, enhancing their investment strategies.

- Collaborative Partnerships: As seen in previous successful collaborations, influencers and investment committees can form strategic partnerships to leverage each other's strengths. This synergy can lead to innovative investment opportunities and more effective asset management.

- Focus on Diverse Asset Classes: With the rise of social media, investment committees may expand their focus to include diverse asset classes such as private equity and real estate. This diversification can help mitigate risks and optimize returns in a volatile market.

- Enhanced Risk Management: The use of social media data can improve risk management practices. By staying informed about global trends and potential risks, committees can make more informed decisions, safeguarding their investments.

- Long-term Strategic Planning: Investment committees will likely place greater emphasis on long-term strategies that align with the evolving social media landscape. This approach can ensure sustainable growth and stability in global investments.

As the head of investment committees and managing directors continue to adapt to these changes, the integration of social media into their operations will become increasingly crucial. By staying ahead of these trends, investment committees can maintain their competitive edge in the global markets.