Understanding the Importance of Equity in Social Media

The Role of Equity in Social Media Influence

In the fast-paced world of social media, understanding the importance of equity is crucial for influencers aiming to build a sustainable and impactful presence. Equity, in this context, refers to the value and trust that influencers cultivate with their audience over time. This is not just about financial gains but also about establishing a strong, credible brand that resonates with followers.

Equity in social media can be likened to an evergreen private equity strategy, where the focus is on long-term growth and stability rather than short-term gains. Just as investors look for consistent returns and a robust portfolio, influencers must aim to create content that consistently delivers value to their audience.

Building Trust and Value

For influencers, building equity involves creating authentic connections with their audience. This means being transparent, engaging, and consistent in their messaging. Much like a mutual fund manager who carefully selects assets to maximize returns, influencers need to curate their content and collaborations to enhance their brand's value.

Investors in mutual funds often look at metrics like the expense ratio and the Sharpe ratio to assess performance. Similarly, influencers should evaluate their engagement rates and audience feedback to measure their equity's health. This approach ensures that they are not just gaining followers but also building a loyal community that trusts their recommendations.

Strategic Planning for Equity Growth

Developing an effective equity strategy requires a comprehensive plan. Influencers should consider diversifying their content, much like a well-balanced portfolio, to appeal to a broader audience. This involves experimenting with different content formats and platforms to see what resonates best.

Moreover, just as investors use SIPs (Systematic Investment Plans) to steadily build their investment over the years, influencers should consistently engage with their audience to nurture and grow their equity. This steady approach helps in maintaining relevance and authority in the ever-evolving social media landscape.

Identifying Key Elements of an Effective Equity Strategy

Pinpointing Fundamental Components

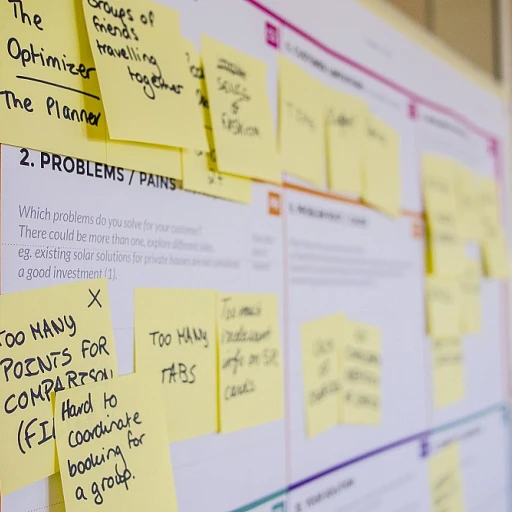

Creating an effective equity strategy in social media goes beyond simply amassing a following. It involves dreaming bigger and strategizing well to ensure long-term growth and substantial returns. Here are a few pivotal elements to consider:

- Diversified Portfolio: Just like in mutual funds, diversifying your social media content is crucial. Different types of content cater to varied audience segments and improve engagement rates, much like a balanced portfolio enhances fund returns.

- Strategic Investment: Consider your time and resources as investments. Allocate them wisely across different platforms, akin to utilizing a unit scheme or employing a mutual fund approach, to yield better engagement and audience growth.

- Measured Actions: Applying principles similar to the Sharpe ratio, evaluate the risk-adjusted return of your efforts. Every plan unit of investment in producing quality content should align with anticipated audience engagement.

- Expense Management: Managing expenses in content production is crucial. It resembles maintaining a low expense ratio in a fund, ensuring funds are directed towards strategies with the highest potential returns.

- Long-term Plan: Much like ELSS tax or SIPs in mutual funds, think about the longer vision and consistent growth. Developing an equity plan that stretches over months or even years helps in creating a sustainable influence.

The intricate process of developing an effective equity strategy requires precision and financial acumen. For insights into the foundational role of evergreen private equity and its impact on social media influence, explore the detailed discussions on preserving and advancing influence sustainably.

Leveraging Partnerships and Collaborations

Fostering Synergy through Collaborations

In the realm of social media influence, leveraging partnerships and collaborations is pivotal for crafting an effective equity strategy. The right collaborations can amplify your influence and provide substantial returns on investment. As you build your equity plan, consider forming collaborations with other influencers, brands, and even fund managers who share similar values and goals.

Integrations like these can not only broaden your reach but can also enhance your content quality. Collaborations often allow for mutual fund-like benefits — pooling resources can lead to a diversified portfolio of content, spreading the risk, and boosting the potential returns for all parties involved.

Investing time in establishing these partnerships can initially seem daunting, but the potential returns, akin to a well thought out mutual fund scheme, are worth the effort. Partnering with influencers and brands that align with your mission can elevate your strategy by making your equity plan unit stronger and more diverse. Consider building relationships that empower both sides to thrive in this competitive market.

Keep in mind, as in any investment or partnership, there is a balance between cost and benefit. Monitoring factors like the expense ratio — the cost of maintaining these partnerships relative to the benefits received — is crucial to ensure that your collaboration plan stays profitable in the long term.

Finally, remember that the ultimate goal of these collaborations is to create a synergistic environment that benefits all parties. By fostering genuine connections and maintaining authentic engagements, you can position your equity strategy for enduring success in the dynamic world of social media influence. For more insights into maintaining authenticity while collaborating, visit our post on the power of authenticity in influencer marketing.

Navigating Challenges in Equity Building

Navigating Hurdles in Equity Growth

Building equity as a social media influencer can present various challenges, which can significantly impact your investment strategy and eventual returns. It is essential to have a well-structured plan to address these barriers effectively.

Firstly, the dynamic nature of social media markets requires continuous adaptation. Influencers face the task of maintaining their brand's visibility and engagement amidst ever-changing algorithms and content trends. Working with a dependable fund manager can help in structuring a responsive portfolio that accommodates market fluctuations.

Another major hurdle is understanding the intricate details of mutual funds and equity plans. For instance, the subtle difference between a UTI mutual fund and a UTI master equity scheme could determine investment successes over several years. Engaging in a systematic investment plan (SIP) can encourage disciplined investing in mutual funds, which allows small, consistent investments that can mitigate risks and enhance fund returns over time.

The expense ratio of mutual funds is another factor to consider, as high expense ratios can eat into your overall returns. Influencers should leverage their understanding of trading accounts and various tax saver options, such as ELSS tax sections, to optimize their tax liabilities and maximize net gain.

Equity building is a long-term endeavor. The journey from selecting schemes to measuring NAV and evaluating returns over years and months requires patience and persistence. You may face periods of low performance; however, setting up a diverse equity plan using multiple funds SIP or an adaptive unit scheme can provide a stable foundation for growth.

To manage risk effectively, measuring performance through metrics like the Sharpe ratio and comparing against category averages can provide insights into a fund's performance related to its financial market risks.

By proactively addressing these challenges, influencers can ensure a robust equity strategy that stands resilient against market volatility and paves the way for sustainable growth in their financial endeavors.

Measuring the Success of Your Equity Strategy

Tracking Performance Through Metrics

To ensure the effectiveness of your equity strategy, it's crucial to measure its success using a blend of traditional and social media-specific metrics. This is not only essential for tracking progress but also for refining your approach to achieve better results consistently.

Engage with metrics that resonate well with the nuances of social media influence. Metrics like engagement rates, audience growth, and brand sentiment serve as beacons to guide your strategy. These traditional measures ensure that you have a direct line of sight into how your equity plan is developing over time.

Analyzing Financial Returns

In the realm of social media, this translates to understanding the impact of your engagement on monetization and personal branding. Implement a comprehensive approach to measure returns, akin to monitoring fund returns in a financial context. Consider the direct revenue generated from partnerships or branding initiatives as a return on investment that needs to be evaluated periodically. Just like a mutual fund portfolio, continuously assess how each component of your strategy contributes to your overarching equity goals.

Leveraging Social Media Analytics Tools

Several tools offer insights into the effectiveness of your strategy. These platforms allow you to see the nitty-gritty details of your social media equity's performance without manually combing through data. It's similar to how fund managers use analytics for mutual fund investment, providing you with detailed reports on audience interaction, content reach, and more.

Utilizing Benchmarking Techniques

Benchmarking your strategy against industry standards can provide insights into where you stand in the competitive landscape of social media. Take cues from established equity plans and adjust your targets and execution style to stay ahead of the curve over the years.