Defining a Capital Call

Exploring the Definition and Relevance in Investment Landscapes

Understanding the concept of a capital call is crucial for anyone venturing into the world of investments, particularly within the realms of private equity and venture capital. At its core, a capital call is a mechanism by which investment funds request additional capital from their investors or limited partners (LPs). This request is issued by fund managers when they identify lucrative investment opportunities or need to meet capital requirements for ongoing investments. In the investment landscape, funds are typically managed by general partners (GPs), who initially collect a pool of committed capital from various investors. However, rather than demand the entire pledged amount upfront, fund managers will issue calls for capital as and when the need arises. This approach allows investors to maintain cash flows more effectively and reduces the period during which their capital remains idle. Limited partners in a fund are usually given a specific timeframe to fulfill the capital call, ensuring the fund can deploy capital effectively into desirable investments such as real estate, venture capital, or other equity opportunities. Investors' ability to meet this call is paramount, as failing to do so can result in penalties or a dilution of their investment stake. A comprehensive understanding of capital calls provides insight into what strategies fund managers employ to maximize returns from committed capital without exerting undue pressure on investors' cash flow. As detailed in our discussion on the difference between Gross IRR and Net IRR in social media influence, the effectiveness of capital calls can also be a determining factor in investment performance metrics and overall fund valuation.The Mechanics of Capital Calls

Essential Elements of Capital Call Mechanisms

Capital calls are an integral process within the realm of private equity and venture capital investments. When an investor—the limited partner (LP)—commits to a fund, they promise a certain amount of capital, known as committed capital. However, this capital is not required upfront. Instead, it is drawn down progressively through capital calls. Fund managers, often referred to as general partners (GPs), initiate these calls when they require cash to finance new or existing investments. To facilitate this, they issue a capital call notice to the LPs, specifying the amount of committed capital that needs to be fulfilled and the deadlines by which the LPs are expected to supply their portion of funds. This mechanism ensures that cash flows within the fund remain efficient and that GPs have readily available resources to respond to investment opportunities. The capital call process also involves careful management of cash flow and liquidity. Fund managers may utilize credit facilities or lines of credit to bridge temporary gaps between the capital needs of the fund and the availability of cash from LPs. This approach can provide a smooth operational flow until the called capital is received from all investors. In practical terms, the sequence of capital calls can sometimes place a financial annotation on an LP. It demands preparedness to meet capital commitments, whether for real estate acquisitions, various types of fund investments, or other equity commitments. Understanding how capital calls work within this structured form of investing can help investors better manage their own financial expectations and commitments. Moreover, grasping these mechanisms can also empower influencers who wish to offer credible advice in financial education and expand the scope of their own influence. For more insights on financial strategies in influencer marketing, check out this informative piece on the opportunity cost formula in social media influence.Impact of Capital Calls on Investors

The Ripple Effects of Capital Calls on Investors

In the intricate landscape of finance, capital calls serve as a pivotal moment for investors. These calls, activated by fund managers, require investors to contribute their previously committed capital to ensure the smooth operation of a fund. The act of deploying this cash, however, presents both opportunities and challenges. For investors in private equity, venture capital, or real estate funds, capital calls are a routine part of the investment cycle. They sustain the funds as they engage in a variety of investment activities. Still, the nature and timing of these capital calls can significantly influence an investor's cash flow management.- Cash Flow Management: Investors must have liquid assets ready to meet their obligations when a capital call is issued. This necessity to maintain a balance can sometimes stress cash flow, particularly when calls are made unexpectedly or during unfavorable market conditions.

- Impact on Investment Returns: While capital calls are essential for achieving the targeted returns from a fund's investments, they also mean that cash remains idle until it is called upon, potentially impacting overall returns. Investors must carefully strategize to mitigate any disruptions in their cash flows while aiming for the desired returns. A detailed understanding of this is crucial, and interested readers can explore the nuances of gross and net returns.

- Fund's Credit Facilities: In some cases, fund managers may opt to use credit lines or call facilities to provide immediate liquidity, postponing capital calls. This strategy allows investors time to prepare for the cash outflow but can also introduce costs associated with these credit facilities.

Capital Calls in the Context of Social Media Influence

The Role of Capital Calls in Social Media's Financial Landscape

When it comes to the world of private equity and venture capital, the concept of capital calls holds significant weight. For influencers operating in this niche, understanding and communicating the nuances of capital calls is crucial for shaping their content and audience engagement.

A capital call, a formal request made by fund managers, asks investors—commonly referred to as limited partners (LPs)—to supply a portion of their committed capital. Private equity and venture capital funds utilize this mechanism to ensure that when an opportunity arises, sufficient cash is available to seize it. By naturally connecting with common investment vernacular, influencers can demystify these terms and help bridge the gap between complex investment strategies and their audiences.

Using relatable examples can simplify the mechanics of capital calls for an audience. For instance, equating committed capital to a pledged amount for a charity marathon aids in comprehension. Here, the capital call acts as the moment when participants are asked to fulfill their pledge—this resonates well with an audience potentially unfamiliar with investment jargon.

In integrating social media influence with financial education, influencers must also address the implications of these financial maneuvers. Understanding what capital calls mean, especially in the context of an investor's cash flow, is vital. Cash flow management becomes essential when the call is made, particularly for limited partners with numerous investments pulling on their resources.

While discussing capital calls, influencers might find opportunities to draw parallels to the real estate sector, where similar funding practices are prevalent. Explaining how private funds operate, including their utilization of credit lines and call facilities, can enhance audience comprehension and engagement.

Therefore, the communication strategy surrounding capital calls should focus not only on educating audiences about the mechanics but also empowering them to make informed decisions. Whether through content on calls work in various industries or enlightening them about alternatives in fund commitments, influencers have a unique role in shaping financial literacy in the digital space.

Challenges Faced by Influencers in Financial Education

Common Obstacles in Financial Education for Content Creators

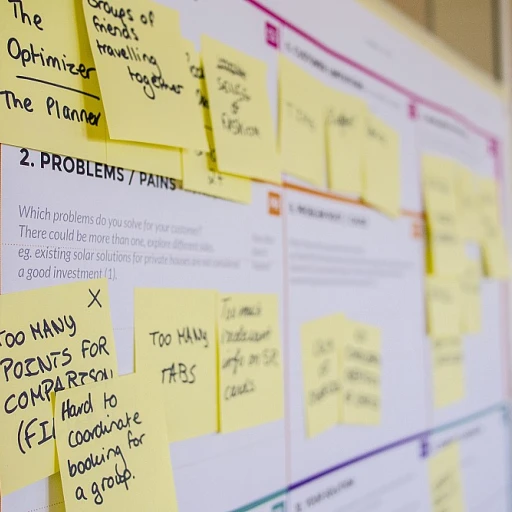

In the dynamic world of social media, influencers are often faced with numerous challenges when it comes to educating their audience on financial topics such as capital calls and private equity investments. These challenges can impede their efforts to effectively convey complex information, such as the intricacies of call facilities or the role of fund managers and limited partners (LPs) in managing committed capital.- Complex Subject Matter: Financial topics, including capital fund dynamics and cash flow management, are inherently complex. Concepts like cash calls work, committed capital, and investment facilities require a deep understanding and often seem daunting for those unfamiliar with the finance sector.

- Misunderstanding Among Audiences: Another significant hurdle is the general audience's lack of familiarity with financial jargon. Terms such as GP (general partner) calls, equity investments, and real estate credit lines can alienate followers who might not grasp the nuances, leading to disengagement.

- Balancing Engagement and Education: Keeping content engaging while being educational is a delicate balance. Creators must ensure that topics such as issue capital or cash flows are presented in an accessible manner without oversimplifying the information, which could lead to misinformation.

- Privacy and Confidentiality: Discussing financial matters often involves sensitive information. Influencers must tread carefully, ensuring they don't disclose confidential data or give specific investment advice that could legally implicate them.

Strategies for Influencers to Engage Audiences with Financial Content

Engaging and Educating Audiences on Financial Concepts

Influencers play a crucial role in breaking down complex financial concepts like capital calls and making them accessible to their audiences. By employing effective strategies, influencers can ensure their content on topics like private equity, venture capital, and real estate resonates with both novice and seasoned investors.Here are some effective methods influencers can use:

- Use relatable language: Simplifying jargon-heavy topics by using everyday language can help in demystifying concepts such as committed capital and credit lines. Influencers should focus on a conversational tone that steers clear of technical terms, unless they are clearly defined.

- Create engaging visuals: Diagrams, infographics, and videos can be powerful tools in explaining how capital calls work. A well-structured visual representation of cash flows, or how a fund manager navigates an investment, captures attention and enhances understanding.

- Share real-world examples: Illustrating the impact of capital calls on investors with real-world scenarios can showcase the benefits and challenges of investments in private equity funds and call facilities.

- Highlight key takeaways: Providing summaries or key points at the end of each post can reinforce learning and aid in memory retention. Summary sections help audiences quickly understand significant topics such as the role of limited partners and fund managers.

- Encourage interaction: Creating a dialogue by asking questions or encouraging comments helps build a community of engaged learners who can exchange insights and experiences. Discussions around issues like paid capital and the strategies LPS use to meet capital calls offer valuable perspectives.

By implementing these strategies, influencers can empower their followers with insightful knowledge, fostering a community of investors who are well-informed on intricate financial subjects like capital call mechanisms and their implications in various investing scenarios.