Understanding Accredited Investors

Decoding the Concept of Accredited Investors

To begin with, understanding the concept of accredited investors is crucial for social media influencers aiming to navigate this complex landscape effectively. An accredited investor is defined by specific financial criteria set by regulatory bodies such as the Securities and Exchange Commission (SEC). These criteria primarily revolve around income, net worth, and certain professional qualifications. Typically, an individual must have an income exceeding $200,000 ($300,000 for joint incomes) or a net worth surpassing $1 million, excluding their primary residence, to qualify. It's pertinent for influencers to familiarize themselves with these requirements as they position themselves to engage with potential investors. Knowing the definition of accredited and investor status is not only vital for compliance but also enhances the persuasive power when approaching potential collaborators. Verification of this status necessitates a detailed look into credit reports and financial documentation, typically performed by a third-party entity. For influencers, cultivating a rapport with accredited investors opens new avenues for investments, especially in private sectors such as hedge funds, real estate, and private company securities. This synergy can substantially amplify the influencer's authority and reach within niche investment communities. To delve deeper into the foundational aspects influencing such economic interactions in social media, check out our detailed post on economic principles in social media acquisitions. Engaging foreign investors introduces additional layers of complexity. However, bridging these connections can potentially unlock untapped financial and cultural capital—further cementing an influencer’s role as a critical player in the global economic narrative.The Role of Foreign Investors in Social Media

Harnessing Foreign Influence

The rise of social media influence has opened a myriad of opportunities for foreign investors. This dynamic landscape allows them to participate in and capitalize on global trends, reaping the benefits of a broad audience reach and the rapid growth characteristic of social media platforms. Foreign investors, often seeking novel markets, find social media influencers a promising avenue for diversifying their investment portfolios. With the ability to advertise products and services to extensive follower bases, influencers frequently serve as key players in fortifying a company’s brand presence. This collaboration benefits investors by enhancing the value of their investments, whether in hedge funds or other securities. Unlike traditional accredited investors, foreign investors may not need to meet the stringent income and net worth requirements set forth by regulatory bodies, such as the Securities Exchange Commission. However, this does not exempt them from verifying their status when investing in private funds or real estate through a third party, ensuring they're compliant with relevant regulations.Understanding Verification and Compliance

In many jurisdictions, foreign investors are required to undergo certain verification processes, crucial for ensuring transparency and investment security. These processes typically involve verifying their investor status through credit reports, financial statements, and sometimes registered investment advisors. Moreover, foreign investors, while part of the influencer's target demographic, must also be aware of the legal and financial considerations unique to cross-border investments. This includes understanding their obligations for income taxes based on their residence and the primary residence exclusions when calculating net worth. For influencers aiming to attract foreign investment, understanding these complexities is vital. It not only aids in engaging these investors effectively but also ensures the influencer's endeavors align with legislative mandates. By learning about various types of investments, like equity and securities, influencers can present themselves as more appealing partners for these opportunities. To further explore the intricate dynamics of investments, influencers can benefit from resources such as those discussing the complexities of series investments and equity structures. Check out this understanding equity waterfall structures guide that delves into multi-partner ventures and joint investments.Challenges Faced by Influencers Without a Specific Category

Overcoming Obstacles in the Path to Influence

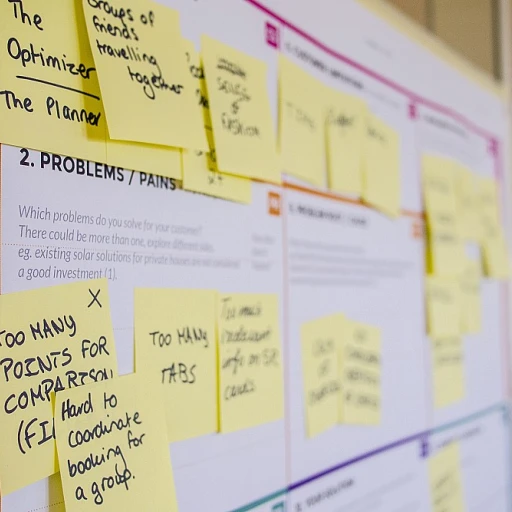

As social media continues to thrive as a powerful platform for networking and marketing, influencers face unique challenges when engaging with foreign investors. Influencers who fall outside a specific or core category may find it daunting to connect effectively with these investors. Understanding the dynamics of accredited investors and the importance of investor verification is crucial in bridging this gap.

One significant challenge influencers encounter is the lack of a streamlined process for establishing investor verification. This verification is essential as it confirms an investor's accredited status, ensuring they meet the necessary net worth and income qualifications. Navigating the formalities required by the securities exchange commission can be time-consuming and complex, particularly when managing real estate investments or hedge funds targeted at foreign investors.

Another obstacle is the intricacies involved in communicating the benefits of private investments to a diverse audience. Influencers must possess a clear understanding of the definition of accredited investors to convey their messages effectively. They should illustrate how foreign investors can leverage their net total assets, excluding their primary residence, to access potentially lucrative opportunities.

Furthermore, influencers without a focused niche may struggle to maintain a consistent brand message, hindering their ability to attract investors. This is compounded by the need to grasp different cultural perspectives and the legal stipulations that vary across borders, all while building trust with investors.

Influencers aiming to overcome these hurdles must stay informed about the latest strategies and resources available, including those employed by notable investment firms. For further insights into the benefits accredited investors provide in the realm of social media influence, exploring successful case studies and adopting innovative engagement strategies can also serve as a blueprint for navigating this complex landscape.

Strategies for Influencers to Engage Foreign Investors

Connecting Influencers with Foreign Investors

In the dynamic world of social media, connecting effectively with foreign investors can unlock a new realm of opportunities. Influencers aiming to engage these investors must adopt targeted strategies that align with the investment interests and needs of international stakeholders. Firstly, it's essential for influencers to understand the accredited investor criteria, especially when dealing with foreign investors who might not fit traditional domestic definitions. This understanding helps in pinpointing those who qualify for investment opportunities that impact net worth and income thresholds, outside of the primary residence considerations. Influencers should consider creating content around high-value sectors, particularly those with substantial involvement from foreign entities, like real estate, hedge funds, and tech enterprises. This alignment draws the attention of those investors looking to diversify or enhance their investment portfolio within a private fund or series. Efficient communication can be reinforced through leveraging third-party platforms that cater to investor verification. These platforms often provide a structured method of reaching out and verifying the investor status of foreign entities. Understanding such structures helps avoid complexities surrounding the securities exchange commission regulations. Moreover, influencers should frame their narratives to highlight the financial tools and products available to foreign stakeholders. This includes discussing the benefits of augmenting their assets and the flexibility of registered investment platforms that cater to global needs. Adopting a personalized approach, where influencers explore the cultural nuances and specific residence-related investment advantages, can significantly enhance engagement levels. Tailoring content that resonates with the local norms and investment aspirations of foreign investors ensures meaningful interactions and long-term partnerships. Finally, it's critical for influencers to stay abreast of the legal and financial considerations outlined by regulatory bodies. By addressing these factors, influencers can ensure that their engagement strategies are not only effective but also compliant.Legal and Financial Considerations

Key Legal and Financial Aspects for Influencers

For influencers considering engaging with foreign investors, navigating the legal and financial landscape is crucial. Understanding the definition of an accredited investor is essential, as it sets the groundwork for who qualifies to invest in certain private funds and securities. Firstly, influencers must recognize that an accredited investor in many regions, including the U.S., is defined by the Securities and Exchange Commission (SEC). This typically involves meeting specific net worth or income benchmarks, excluding primary residence in net worth calculations. Verification of investor status often requires documentation such as a credit report or third-party certifications to ensure they meet the criteria. When foreign investors are involved, the complexities increase as influencers must acknowledge different regulations depending on the investor's country of residence. This includes understanding minimum investment requirements and whether investors need to be certified by a recognized entity in their jurisdiction. Moreover, legal guidance is often required to ensure compliance when dealing with cross-border investments. Influencers must align with private companies and registered investment advisors familiar with securities exchange regulations. In managing financial aspects, being transparent about investment opportunities and potential risks is vital. Influencers should partner with entities that offer thorough investor verification processes. Engaging accredited investors requires clarity in financial communication to uphold trust and credibility. Influencers considering this frontier in social media influence should stay informed through continuous education on legal, financial, and regulatory developments. This proactive approach aids in maintaining a reputable status, essential for fostering lasting relationships with foreign investors, companies, and hedge funds alike.Case Studies: Success Stories and Lessons Learned

Remarkable Success Stories in the World of Social Media Influence

Navigating the intricate landscape of accrediting foreign investors in the realm of social media can be challenging. Yet, there are notable success stories that highlight the potential and opportunities available. These case studies illustrate how influencers have capitalized on engaging with foreign investors, shedding light on best practices and lessons learned along the way.- Innovative Engagement Strategies: One inspiring example is an influencer who effectively leveraged their platform to attract foreign investors by hosting interactive webinars and exclusive content offerings. By offering unique insights and investment strategies relevant to foreign markets, the influencer was able to cultivate trust and establish credibility with high-net-worth investors.

- Effective Use of Investor Verification Tools: Another success story highlights an influencer who incorporated accredited investor verification processes seamlessly into their operations. Through decisive use of third-party verification services, this influencer ensured that potential investments aligned with securities exchange regulations, thereby fostering a transparent and secure investment environment.

- Diversification with Private Funds: Some influencers have succeeded in diversifying their investor base by engaging foreign investors through private funds. By tailoring investments to meet the particular requirements and preferences of these investors, including minimum investment thresholds, these influencers have expanded their reach, adding significant value to their financial portfolios.