The Interplay of Market Forces

In the complex world of social media mergers and acquisitions (M&A), understanding the market dynamics at play is crucial. Market dynamics refer to the forces that impact the supply and demand characteristics of a given market. In the sphere of M&A, these dynamics are often a reflection of the economic principles guiding the strategies of acquiring companies and target firms.

Market share is a significant determinant in the valuation and attractiveness of a target company. High market share often signals strong performance and a competitive position, making such companies attractive targets for acquisition. This is especially true in the social media industry where user base and engagement levels are critical metrics of success.

Moreover, economic data analysis provides insights into market trends and shifts, enabling firms to make informed decisions about potential acquisitions. The M&A process involves thorough scrutiny of market indicators to predict shifts and identify opportunities for strategic management.

Cross-border M&A deals add another layer of complexity as they must contend with international business regulations and cultural differences. Yet, they present companies with opportunities to expand their market presence globally, tapping into new user bases and diversifying their portfolio.

In an increasingly competitive landscape, where class imbalance might exist, companies often resort to triangular mergers to optimize their market position without direct competition. This involves a three-way merger where the acquiring company forms a new entity to facilitate the acquisition, often a strategic move in regions like the United States.

Ultimately, a successful merger or acquisition requires a keen analysis of the market dynamics, financial health, and overall business performance of the target firms. This ensures that the end goal of such corporate decisions—either enhancing market share or accessing new technologies—aligns with the long-term strategic vision of the acquiring firm.

Understanding Social Media Valuation Techniques

In the ever-evolving landscape of social media, mergers and acquisitions (M&A) transactions have become increasingly prevalent. Accurate valuation of social media platforms is integral to these acquisitions, allowing acquiring companies to assess potential gains in market dynamics and economic performance.

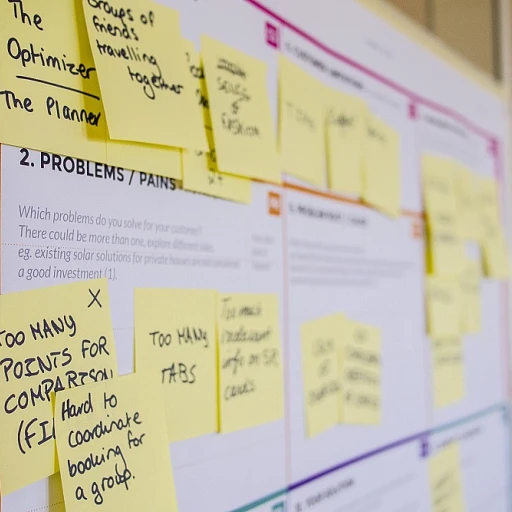

Various financial and strategic methods are employed by acquirers to assess the worth of target companies. Commonly used techniques include:

- Discounted Cash Flow (DCF) Analysis: This method forecasts a company's future cash flows, which are then discounted back to their present value. It offers a detailed insight into a firm’s financial health, factoring in growth potential and risk.

- Comparable Company Analysis (CCA): With this approach, target firms are compared against similar firms in the market. Analysts examine multiples like Enterprise Value/Revenue or Enterprise Value/EBITDA to gauge fair market value.

- Precedent Transactions Analysis: Historical M&A deals are analyzed to offer benchmarks. This method provides context by referencing past transactions involving similar companies, offering a clear view of industry trends and pricing strategies.

Valuation isn't solely about crunching numbers. M&A activity in social media often pivots on less quantifiable elements like technological advancements, user data valuation, and cross-border synergy potential. For instance, understanding the influence of network effects can offer deeper insights into a platform's market share and revenue capabilities, vital in managing the acquirer-target relationships.

As the social media sphere expands, recognizing its intricate economic principles becomes imperative for strategic management, ensuring informed decisions in this dynamic M&A process.

Network Effects and Their Influence on Acquisitions

The Weight of Network Power in Mergers & Acquisitions

Network effects hold a pivotal role in shaping social media mergers and acquisitions (M&A). In the world of business, the power of interconnected users directly influences the desirability of target companies. A strong network effect can often increase the acquisition's value, which makes other factors like market dynamics more vital.

When a company is evaluating a target, the strength and potential for user growth are meticulously analyzed. Firms aim to predict how the network will react and thrive under a new acquirer. This method provides critical insights during the m&a process, shedding light on the future influence of a social media company's user base in potential mergers acquisitions.

The importance of these network dynamics was evident in notable m&a activity, such as the Time Warner acquisition. These transactions underscore how acquiring companies often leverage an existing network to expand their market share.

However, reliance on network effects in economic analysis requires a balance. M&A transactions must also consider regulatory considerations, as these network-driven advantages can lead to concerns over market power and competition, sometimes resulting in class imbalance scenarios.

Therefore, network effects in M&A deals in the realm of social media are intricately linked with various business strategies and market forces. Successful navigation of these waters allows companies to better integrate target firms, maximizing economic and strategic management outcomes.

Understanding Regulatory Challenges in Mergers and Acquisitions

Navigating the regulatory landscape is a crucial aspect of successfully executing mergers and acquisitions (M&A) in the social media industry. This task requires a comprehensive understanding of market dynamics and economic principles, as regulatory frameworks often vary based on jurisdiction and the specific attributes of the target companies involved.

Social media firms, characterized by their vast data sets and expansive market footprints, often attract significant scrutiny from regulatory bodies. The purpose of such scrutiny is mainly to ensure that m&a activities do not lead to monopolistic practices or disrupt competitive market performance. Regulators will examine whether a merger acquisition might unfairly increase the market share of the acquiring company, potentially stifling competition and innovation.

A critical component of the regulatory process is antitrust analysis, which evaluates the potential impact of m&a transactions on market competition. In the United States, for example, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) oversee these evaluations, scrutinizing proposed m&a deals for anti-competitive implications. Organizations involved in m&a activity may often engage in strategic management to address such regulatory concerns, possibly through divestitures or the formation of strategic alliances to maintain a balanced industry ecosystem.

Additionally, non-compliance with regulatory standards can have significant financial and reputational consequences for both the acquirer and the target firm. Therefore, effective management teams emphasize due diligence during the m&a process. This includes thorough analysis of the regulatory environment, potential restrictions, and the likelihood of obtaining necessary approvals.

In international business scenarios, cross-border mergers can add another layer of complexity. Regulatory authorities in different countries may have divergent views and differing requirements, leading to extended timelines and increased costs for m&a transactions. For instance, the European Union may impose different antitrust conditions than those in the United States, necessitating a tailored approach to managing these cross-border acquisitions.

Ultimately, understanding these regulatory considerations is vital not only for completing successful mergers and acquisitions but also for maintaining sustainable target prediction and class imbalance in the market. As firms navigate these challenges, they must balance financial and strategic incentives with regulatory compliance to achieve long-term business objectives.

Impact of Acquisitions on Influencer Revenue Streams

Changes in Revenue Streams for Influencers

The landscape of mergers and acquisitions (M&A) in social media directly affects the revenue streams of influencers. As acquiring companies undergo restructuring, influencers may have to adapt their strategies to thrive in the evolving market. Let's delve into how these shifts impact their earnings.

One of the foremost impacts of social media acquisitions is the change in the monetization models. After acquisitions, the acquiring company may alter how content is monetized, potentially leading to a class imbalance where specific types of content are prioritized. Influencers operating in these spaces may see fluctuations in their earnings, forcing them to reevaluate their strategies.

The economic performance and strategic management of the target company can also have significant implications. For instance, if the acquirer decides to emphasize a new direction or market share increase, influencers must align to remain competitive. Companies may introduce new revenue-generating features or modify existing ones, thereby directly affecting influencers’ profit margins.

Acquisitions often lead to the integration of new technologies and data analytics into social platforms. This enhances the ability of influencers to target predictions more accurately, enabling them to better tailor their content to their audience’s preferences. In such scenarios, influencers who adapt efficiently to these advanced tools and actively utilize them in their targeting strategies are more likely to maintain or even increase their revenue streams.

Furthermore, firms involved in cross-border M&A deals may bring different regulatory environments into play. Influencers must stay informed about these changes to ensure compliance and capitalize on opportunities that arise in international business landscapes.

In the wake of mergers and acquisitions, companies might shift their focus toward more strategic alliances and partnerships. The performance of an acquiring company post-merger can dictate the availability of new partnership opportunities and promotional activities for influencers, potentially opening up lucrative revenue streams. As influencers continue to navigate these dynamic situations, staying agile and informed is key to sustaining their financial growth and market presence.

Strategic Alliances and Partnerships Post-Acquisition

How Alliance Structures Can Encourage Growth

In the fast-paced world of social media, mergers and acquisitions are not merely about a change of ownership but serve as a pivotal point for strategic alliances and partnerships. After an acquisition, these partnerships often prompt a reevaluation of business strategies, encouraging growth both within the acquiring company and the target company. Strategic management of these alliances is crucial to ensure stability and progress in a highly competitive market.

One of the main drivers of growth post-acquisition is the expanded market share. By merging their respective consumer bases, firms can leverage cross-border opportunities to access new audiences, tapping into previously unreachable international business markets. The ability to share resources, data, and financial capabilities across borders provides a significant advantage, leading to a stronger market performance.

Moreover, the formation of alliances post-merger acquisition facilitates an environment ripe for innovation. By combining the strengths of both the acquirer and target firms, companies can drive forward new initiatives that align with their strategic goals, sometimes reshaping the landscape of the social media industry itself. The collective expertise drawn from these alliances can catalyze the development of new tools, services, or platforms, which in return strengthen their competitive edge.

For influencers, these mergers acquisitions can unlock new revenue streams. The acquirer can introduce influencers to novel promotional opportunities or diversify the methods of engagement. As a result, influencers may gain access to novel platforms or audiences, enhancing their visibility and engagement metrics.

In conclusion, strategic alliances and partnerships post-acquisition play a crucial role in shaping the trajectory of social media companies. The cooperation between the acquiring company and the target companies isn't just about assimilating different operations. Instead, it reflects how these entities can jointly harness their synergies to realize greater economic benefits and market potential. Insightful analysis, therefore, becomes fundamental in recognizing how m&a deals influence both companies and influencers alike during the ever-evolving m&a process.