Navigating Equity Waterfalls in Collaborative Ventures

Diving into Real Estate Equity Waterfalls

Navigating equity waterfalls in collaborative ventures requires a keen understanding of both the financial structures and the interpersonal dynamics inherent in such partnerships. Equity waterfall structures are critical in aligning the interests of investors and general partners, ensuring that returns are distributed in a manner which rewards both capital contributions and performance achievements. In a typical waterfall model, cash flows are divided according to a predefined hierarchy. Beginning with the return of the initial capital to limited partners, the cash flow proceeds through tiers of preferred returns, which are often expressed as a preferred return rate or as an internal rate of return (IRR) hurdle. The distribution waterfall determines the subsequent flow into the pockets of investors and general partners based on their respective stakes. Real estate projects often employ equity waterfalls to methodically allocate returns among multiple partners. For instance, in estate equity investments or commercial real estate ventures with multiple limited partners, reaching the hurdle rate is paramount. This threshold ensures that investors receive their promised cash flows before any additional distributions are made to promote or compensate the general partner. However, these structures can be complex, especially when dealing with a variety of stakeholders. For more insights about how these intricate waterfall structures operate within venture funds, you can explore this resource on understanding the cash flow waterfall in venture capital funds. Ultimately, harnessing the benefits of equity waterfall models requires careful planning and transparent communication among all parties involved. This ensures that the investment flow yields desired returns and maintains the cohesiveness of the collaborative venture.The Role of Social Media Influence in Equity Distribution

Amplifying Equity Distribution through Online Platforms

Social media has become more than just a communication tool; it's a vital asset in the realm of equity waterfall structures, especially in complex deals involving multiple limited partners and general partners. By leveraging online platforms, not only can businesses and real estate investors amplify their reach, but they can also facilitate greater transparency and trust among all involved. The concept of a preferred return is critical in the equity distribution process, connecting directly to the role of social media. When these returns are communicated efficiently, it can influence investments and the flow of capital within the equity waterfall model. Transparency through social media ensures that each limited partner is informed about their tier in the distribution process and the status of their returns, thus promoting a more inclusive environment. Moreover, the use of social media enables real-time updates and status reports on investment returns and IRR, fostering a sense of real-time engagement among investors. This becomes particularly useful when addressing the nuances of a waterfall structure, where different tiers and hurdles define the distribution of funds, ensuring that each investor's interests are adequately considered. Understanding the intricate details of distribution waterfalls, such as the hurdles rate or carried interest, can often be complex without clear communication channels. Social media plays a pivotal role here by providing a platform for stakeholders to interact and understand the overall waterfall model. This strategic interaction leads to a more comprehensive grasp of how preferred returns, cash flows, and estate equity align with the overall investment goals. Finally, sharing case studies and past successes via social media can significantly impact how new deals are structured. Highlighting successful implementations of equity waterfalls not only serves as a blueprint but also builds confidence in the current strategies employed for capital distribution. Therefore, the strategic integration of social media in these processes showcases a higher level of expertise and communication, crucial for managing investors' expectations and ensuring the smooth flow of investments. For a deeper dive into related dynamics, you would benefit from understanding the cash flow waterfall in venture capital funds.Challenges of Managing Multiple Partners in Equity Structures

Complexities in Managing Multiple Stakeholders

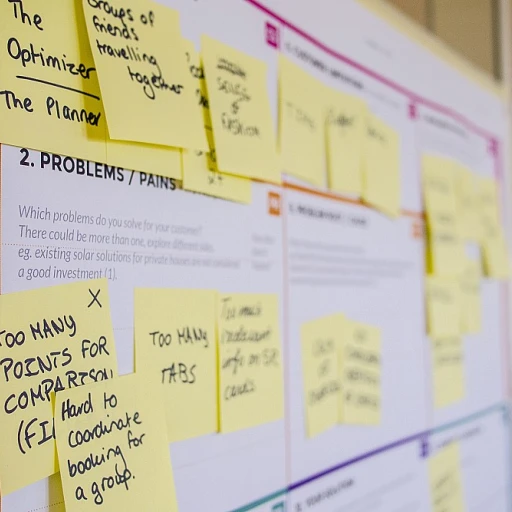

Managing multiple partners in an equity waterfall structure is not without its challenges. Each partner often comes with their own interests and expectations, which can complicate the alignment required to ensure smooth operation and decision-making in collaborative ventures.

The essence of an equity waterfall is to distribute returns to different layers of investors involved in a project. When multiple partners are present, the distribution of cash flows can become a tug-of-war. The preferred return often serves as a benchmark, where initial cash flows are prioritized to reach specific return targets before the profits are split among partners.

- Tiered Distributions: Equity waterfalls typically use tiered waterfalls. It helps in managing the return of surplus cash, often known as the carried interest, to the general partner after the limited partners have received their initial returns.

- Hurdle Rates: Introducing hurdle rates can further complicate the equity returns distribution. These are predetermined rates that must be achieved before crossing into the next tier of profit sharing, requiring precise calculation to ensure fairness and equity among the partners involved.

- Communication Barriers: As partners navigate the complexities of these structures, communication barriers can pose significant challenges. Misunderstandings about the models can lead to disputes, especially if the cash flow distribution does not align with expected returns.

Moreover, the presence of real estate investors in a commercial real estate venture brings another layer of intricacy. Real estate deals are typically long-term, requiring the commitment of capital over extended periods and a sharp focus on managing both the investment risk and the return on investment (ROI). Thus, effective management and communication amongst multiple partners are crucial in successfully navigating these waters.

Leveraging Social Media for Enhanced Partnership Dynamics

Harnessing Social Media for Innovative Partnership Dynamics

In the evolving landscape of equity waterfall structures, social media has emerged as a powerful tool to enhance partnership dynamics. The impact of a well-curated social media presence goes beyond mere brand promotion—it significantly influences how returns, waterfall tiers, and investment decisions are perceived and executed by all stakeholders, including investors and general partners. Social media platforms can provide unprecedented access to insights and real-time engagement with potential investors, thereby influencing the flow of information and shaping decisions in commercial real estate, private equity funds, and beyond. By sharing successes and milestones involving equity distributions, limited partners and other tier stakeholders can be kept informed, ensuring transparency and trust. Moreover, integrating social media strategies into equity distribution processes can align interests more effectively. For example, updates on cash flow timing and distributions optimize communication channels by reaching a broader audience quickly, enabling more synchronized investment decisions. This transparency can reduce friction points that might arise from complex waterfall structures or when managing multiple partners. Additionally, social media amplifies the messaging around the distribution waterfall and preferred return structures, providing clarity on nuanced aspects such as hurdle rates and carried interest. Knowledge sharing through detailed posts or dynamic content helps demystify the waterfall model, leading to a more informed investor community who feel valued and engaged. In summary, leveraging social media effectively in managing equity waterfall dynamics with multiple limited partners enhances trust and clarity. This approach not only ensures a more collaborative environment but also fosters greater investment confidence, fueling growth and innovation within equity structures across various sectors.Case Studies: Successful Equity Waterfall Implementations

Illustrative Examples of Success in Equity Waterfalls

In the complex world of equity waterfalls, certain real-world applications showcase successful implementation despite the inherent challenges. These case studies often illustrate how strategic planning and social media influence intertwine, ultimately impacting investment outcomes.

Consider a scenario in real estate where multiple limited partners (LPs) invest in a commercial property. The equity waterfall is structured to prioritize preferred return to LPs before any carried interest is allocated to the general partner. Such a model ensures the initial cash flow direction aligns with investor expectations and risk appetite.

A key to success in these structures is the strategic use of social media channels to enhance transparency and communication among partners. Social media platforms serve as vital tools to discuss investment flow and adjust strategies quickly in response to evolving market conditions.

- Explored Strategy: Integrating timely updates on cash distributions and project milestones via corporate social platforms, ensuring all partners are aligned and informed.

- Outcome: More cohesive partner relations, resulting in smoother distribution waterfall implementation and an improved internal rate of return (IRR).

While each investment and its waterfall structure are unique, leveraging social media provides a framework to return capital more efficiently, engage with investors proactively, and foster trust among stakeholders. This becomes especially crucial as asset values fluctuate within the competitive landscape of private equity and real estate investments.

Future Trends in Equity Waterfalls and Social Media Influence

Emerging Trends in Social Media-Driven Equity Waterfalls

The landscape of equity waterfalls is evolving, particularly with the dynamic influence of social media. This evolution is increasingly evident in ventures where multiple partners and limited partners (LPs) are involved, reshaping traditional equity waterfall models. As social media transforms into a significant platform for communication and networking, its influence over investment flows and capital distribution becomes apparent. It plays a pivotal role in shaping perceptions and facilitating transparency in the distribution waterfall processes. This transparency affects how preferred returns and cash flows are communicated to investors, enhancing trust and engagement. Here are some trends to watch:- Enhanced Communication: Social media platforms enable real-time updates on investment performances, catering to both general partners and LPs. These updates are crucial for reflecting on the cash flow and tier distributions, directly impacting the perceived rate of return.

- Data-Driven Decisions: Utilizing analytics from social media can improve the prediction of hurdle rate achievements and the subsequent distribution of carried interest. This ensures an optimized flow of returns to estate equity stakeholders.

- Customized Equity Models: With the growing influence of social media, equity waterfall structures become more adaptable. This flexibility caters to varied real estate investments in both commercial and estate sectors, adjusting to the dynamics of preferred return and return capital structures.

- Increased Investor Engagement: Social media facilitates greater investor involvement and understanding, promoting a more cohesive investment community that actively participates in the distribution waterfall decisions.