The Basics of Cash Flow Waterfall

Demystifying the Mechanics of Cash Flow Waterfall

The cash flow waterfall is best understood as a sequence governing the distribution of cash proceeds within venture capital funds. This mechanism plays a crucial role in delineating the flow of returns from investments, ensuring a structured approach to return capital to investors based on predefined priorities. To bust the jargon, in essence, the "waterfall" begins at the culmination of an investment cycle, with the fund collecting returns from their portfolio. A carefully designed waterfall structure then dictates how these proceeds cascade to various stakeholders.- Preferred Returns: The prioritization typically starts with satisfying the preferred return owed to limited partners (LPs). As customary in fund agreements, this preference means reimbursing LPs their original invested capital along with a predetermined return rate, often termed as the "hurdle rate."

- Return of Capital: Following the repayment of the preferred return, the focus shifts to ensuring that any remaining capital reimburses the invested capital back to the LPs.

- Carried Interest: Only after these layers are satisfied are general partners (GPs) entitled to their share of the profits, known as carried interest. This is a crucial element for GPs, as their incentive is intrinsically tied to surpassing certain performance benchmarks.

How VC Funds Utilize Cash Flow Waterfalls

Exploring the Application of Cash Flow Waterfalls in VC Funds

Understanding how venture capital (VC) funds utilize cash flow waterfalls is crucial for social media influencers looking to engage with these investment mechanisms. Cash flow waterfalls represent a strategic financial structure that defines how returns, or proceeds, from an investment are distributed among stakeholders. This system can be particularly intricate in VC funds, allowing stakeholders, such as investors, to maximize their returns while managing risks. The waterfall model in VC funds generally follows a tiered system of distributions, often beginning with a preferred return to Limited Partners (LPs). This preferred return ensures that LPs receive a predetermined percentage before any profits can be distributed to the General Partner (GP) as carried interest. Such a structure emphasizes protecting initial investments and offering returns on invested capital before any further profit-sharing. Here's how venture capital funds typically utilize the waterfall structure:- Tiered Distribution: The distribution waterfall allocates returns in multiple tiers. Initially, the invested capital is returned to the LPs. Once the hurdle rate—the minimum required rate of return—to satisfy preferred equity is achieved, subsequent proceeds are shared according to pre-agreed terms.

- Preferred Return: VC funds prioritize the payment of a preferred return to LPs. This mechanism not only attracts investors but also promotes their engagement by ensuring they receive a defined minimum cash return before the GPs like fund managers realize their share of the proceeds.

- Carried Interest: The incentive for GPs typically manifests through carried interest—essentially their share of the profits after LPs are paid their preferred return. This interest motivates GPs to maximize fund returns, acting as a performance-based reward ensuring alignment between the interests of LPs and the GPs.

- Hurdle Rates: Comprising a crucial component, hurdle rates define the minimum return threshold before GPs can receive any carried interest. This requirement benefits investors by encouraging thorough and profitable investment management from the GPs, aligning fund performance with investor returns.

Impact on Social Media Influencers

The Connection Between Influencers and Venture Capital Funds

In the realm of venture capital, influencers often find themselves playing a unique role. While social media personas are more traditionally viewed as content creators, their endeavors in entrepreneurship also gain attention from venture capitalists. The cash flow waterfall model, specifically, presents various dynamics that can impact influencers at different stages of investment.

When influencers become a part of a fund's portfolio, they may see a distinct opportunity in the form of returns and proceeds driven by the American and European waterfall distribution frameworks. These influencers, akin to limited partners (LPs), aim to receive a preferred return on their invested capital, usually after the general partner (GP) has managed the fund expenses. This structured return of invested capital can significantly benefit those in the social media space.

Navigating the Investment Landscape

For influencers, understanding how funds function—including any applicable waterfall structure—is crucial. In many venture capital models, influencers acting as investors might encounter cash distributions determined by the waterfall model. These investors expect their equity to be distributed according to prioritization rules or the hurdle rate specified in the venture agreements.

In essence, the waterfall dictates both the timing and the scale of returns, ensuring that their investment backers receive the promised preferred return before further cash flows are allocated.

How Social Media Influencers Can Leverage These Opportunities

Ultimately, social media influencers who are informed about venture fund operations stand to benefit significantly. Given their position as both content creators and potential financiers, understanding the intricacies of a cash flow waterfall model enables them to strategically return capital efficiently, maximizing their return on investment. Crucially, influencers should focus on collaborations with trusted fund managers who implement these models effectively, ensuring an equitable distribution of cash returns.

Challenges Faced by Influencers

Overcoming Hurdles in the Influencer Space

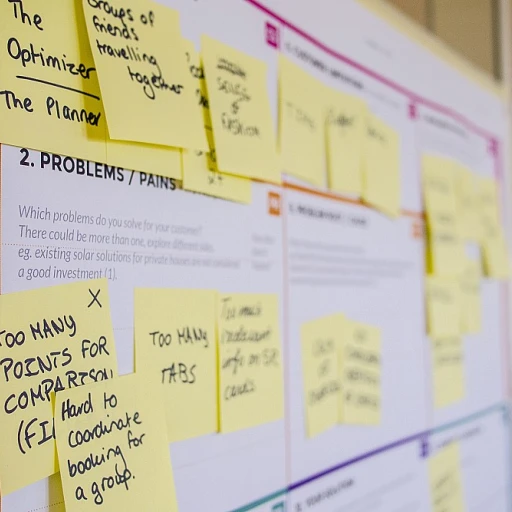

Social media influencers face unique challenges when navigating the intricate world of venture capital funds and cash flow waterfalls. These hurdles can significantly impact their ability to secure investments and maximize returns. Understanding these challenges is crucial for influencers looking to thrive in this competitive landscape.

One of the primary challenges is the complexity of the waterfall model itself. Influencers often struggle to grasp the nuances of how cash flows are distributed among limited partners (LPs) and general partners (GPs). This lack of understanding can lead to misaligned expectations regarding returns and distributions.

Another significant challenge is the preferred return structure. Influencers must be aware that investors typically receive a preferred return on their invested capital before any profits are distributed. This means that influencers might have to wait longer to see any financial benefits from their collaborations with venture capital funds.

Moreover, the hurdle rate can be a barrier for influencers. This is the minimum return that a fund must achieve before the GPs can receive their share of the profits, known as carried interest. If the hurdle rate is not met, influencers may not receive the expected proceeds from their investments.

Additionally, the choice between an American waterfall and a European waterfall can affect the timing and amount of distributions. Influencers need to understand these differences to make informed decisions about their partnerships with venture capital funds.

Finally, the competitive nature of securing investments from private equity and real estate funds can be daunting. Influencers must present a compelling case to attract investors and demonstrate their potential for generating significant returns.

By recognizing and addressing these challenges, influencers can better position themselves to benefit from the opportunities presented by venture capital investments.

Strategies for Influencers

Effective Strategies for Navigating the Cash Flow Waterfall Landscape

Navigating the intricacies of venture capital funds can be daunting for social media influencers. Understanding and strategically utilizing the cash flow waterfall model is crucial to maximize investment potential. Here are key strategies for influencers:- Educate Yourself on Waterfall Models: Familiarize yourself with different types of cash flow waterfalls, such as the American waterfall and the European waterfall. Recognizing these can help clarify how returns are distributed and which models suit your investment goals.

- Leverage Private Equity Opportunities: Venturing into private equity and real estate investments can offer influencers unique avenues for growth. Being aware of the waterfall structure in these investments can ensure you are strategically positioned to reap the benefits.

- Collaborate with General Partners: Forge relationships with general partners and fund managers involved in venture capital. Their expertise can guide influencers in understanding the preferred return, hurdle rate, and carried interest.

- Align with Limited Partners (LPs): Engaging with LPs can provide insights into capital returns and investment strategies, shedding light on distributions and cash flows that ultimately impact your returns.

- Assess Financial Health with the Distribution Waterfall: Regularly evaluate your cash flow and distribution waterfall to ensure investments align with your financial goals. This proactive approach can optimize proceeds and overall capital return.

Future Trends in VC Funding and Social Media

Emerging Trends in Venture Capital and Social Media

The landscape of venture capital is evolving rapidly, and social media influencers are increasingly becoming a focal point for investors. As the waterfall model continues to shape how cash flows are distributed, influencers must stay informed about these changes to maximize their opportunities.

Increased Focus on Digital Platforms

With the rise of digital platforms, venture capital funds are showing a growing interest in investing in social media influencers. This trend is driven by the potential for high returns on investment, as influencers can reach vast audiences and drive significant engagement. As a result, fund managers are keen to include influencers in their portfolios, leveraging the distribution waterfall to ensure optimal returns for limited partners (LPs).

Adapting to New Investment Models

The traditional waterfall structure is being adapted to accommodate the unique dynamics of social media. For instance, the preferred return and carried interest mechanisms are being tailored to better align with the fast-paced nature of digital content creation. Influencers need to understand these adaptations to effectively negotiate their roles within these investment frameworks.

Challenges and Opportunities

While the integration of influencers into venture capital presents exciting opportunities, it also poses challenges. Influencers must navigate complex equity arrangements and understand the implications of different waterfall models, such as the American and European waterfalls. Additionally, the pressure to deliver consistent cash flow and meet hurdle rates can be daunting.

Looking Ahead

As the relationship between venture capital and social media continues to evolve, influencers who stay informed and adaptable will be best positioned to thrive. By understanding the intricacies of cash flow waterfalls and aligning with the right general partners, influencers can secure a stable and lucrative future in this dynamic industry.