Understanding Asset Management and Public Investing

Diving Into the Essentials of Investment

Understanding asset management and public investing is key to navigating this intricate world. Both involve managing resources, financial or otherwise, to achieve specific investment goals. Asset management refers broadly to the professional handling of various securities and financial assets. It is a service rendered by asset managers, who employ various investment strategies to grow client portfolios over time. When it comes to investing in financial markets, public investing takes a central stage. Public markets offer accessibility to stocks, bonds, and securities. Investment management in these markets revolves around mutual funds, equities, fixed income, and more. It's a domain where Goldman Sachs and other asset management companies play pivotal roles, striving to balance risk and returns.Private Markets: An Alternative Avenue

Besides public markets, private markets provide avenues like private equity and venture capital that are less liquid and more hands-on. These types of investments involve direct ownership stakes in companies, unlike publicly traded securities. Managers focusing on private assets often zero in on long-term investment strategies, seeking to enhance value through active involvement.Portfolio Management: The Art of Balance

Investors continually seek to optimize their portfolio management processes, weighing the risk-reward dynamics. Different asset classes like real estate, equities, and fixed income contribute to diversified portfolios, reducing exposure to any one asset's potential downturn. Whether aiming for a tactically nimble or a strategically long-term approach, maintaining diversity in assets is key. Navigating this landscape is not without its challenges. The rise of financial influencers is reshaping traditional advice channels, yet challenges and opportunities for creating effective influence in finance abound. Success in asset management relies heavily on transparency and adherence to ethical practices, creating a strong foundation for the future of investing.The Rise of Financial Influencers

The Evolution of Financial Voices on Social Media

In recent years, the landscape of asset management and public investing has been dramatically transformed by the rise of social media influencers. These individuals have carved out a niche by providing insights into complex financial topics, which were once solely the domain of traditional financial advisors and institutions. The advent of platforms such as Twitter, Instagram, and YouTube has given rise to a new breed of financial influencers who command significant attention from both novice and seasoned investors.

These influencers play a pivotal role in shaping investment strategies and market trends. By simplifying complex terms and demystifying the intricacies of investment management, they bridge the gap between professional asset managers and individual investors. Through engaging content, whether it's a comprehensive breakdown of equity investments or an analysis of public markets, financial influencers have established themselves as credible sources of information on asset classes and portfolio management.

Impact on Public and Private Markets

The influence of social media is particularly evident in both public and private markets. By providing real-time analysis and insights on assets like mutual funds and private equity, influencers offer a fresh perspective that can alter the way investments are perceived. For instance, when they discuss high-profile firms or big names in the industry like Sachs Asset or Goldman Sachs, they lend a personal touch that resonates with individual investors and demystifies the vast world of capital and securities.

This wave of influence has not only benefited public market strategies but has also extended into private markets. By sharing their personal experiences and strategies regarding private asset investments, these financial voices empower their audiences to make informed decisions. As a result, investors feel more equipped to diversify their portfolios with a combination of private and public market investments.

Broadening the Asset Management Conversation

What sets financial influencers apart is their ability to engage their audience through interactive content and direct communication. Unlike traditional fund managers who operate within the confines of formal hedge funds, these influencers offer a more relatable approach to discussing portfolio management and risk assessment.

Through their growing popularity, they challenge the existing norms of asset management and broaden the conversation beyond traditional routes. Whether discussing the nuances of fixed income or the potential of real estate investments, they foster a more inclusive environment where financial literacy is accessible to a wider audience, and newcomers to investing can learn without intimidation.

Challenges Faced by Financial Influencers

Navigating Common Roadblocks in Social Media Finance

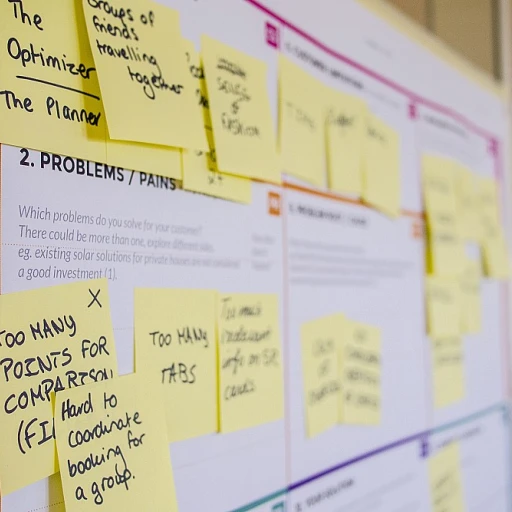

The world of social media is vast, and with the increasing trend of financial influencers sharing their insights on platforms, they face substantial challenges. These roadblocks vary from credibility concerns to the rapid-paced nature of financial markets, affecting both private and public investments.

Firstly, maintaining credibility is pivotal. In the landscape of investment management and asset management, the credibility challenge looms large. Financial influencers must ensure that the information shared resonates with current market trends and reflects informed perspectives on asset classes, be it equity investments, funds, or portfolios. Trust, often built through transparency, is crucial when discussing topics like private equity or public markets.

Another significant challenge revolves around the complexity of financial instruments. Simplifying intricate concepts like fixed income securities or mutual funds without diluting the essence of risk and return in investments is a delicate balance. This is especially essential when communicating to investors unfamiliar with the nuances of asset management or fund strategies.

Financial influencers often encounter the dichotomy of public vs. private markets. Clarifying the distinctions between public investments and private markets can be daunting. Understanding the dynamics of capital involved—from real estate opportunities to private asset management and beyond—requires an in-depth comprehension, which influencers need to convey succinctly.

The ever-changing regulatory landscape adds another layer of complexity. Financial influencers must navigate legalities surrounding financial advice and recommendations. This aspect is underscored by the involvement of larger institutions, such as Goldman Sachs and their sachs asset services, which emphasize regulatory compliance.

Finally, the expectation of delivering real-time insights in alignment with current events presents logistical difficulties. Keeping up with the pace of news and market fluctuations while providing valuable and actionable insights is essential for maintaining investor trust.

As financial influencers maneuver through these challenges, the emphasis on transparency, trust, and up-to-date knowledge remains paramount. By addressing these concerns head-on and cultivating a profound understanding of market dynamics, influencers can augment their authority, benefitting both their followers and the broader investing community.

Strategies for Effective Influence in Finance

Crafting a Strong Influence in Finance

To become an effective influencer in the expansive realm of asset management and public investing, several strategies are imperative. The financial landscape, encompassing asset classes like real estate, fixed income, and private equity, is vast and often intimidating. However, approaching this with informed strategies can help influencers effectively engage with both seasoned investors and newcomers alike. One crucial aspect is offering educational content that breaks down complex financial concepts, such as investment strategy and portfolio management, into more digestible pieces. This approach helps build trust and establishes the influencer as a knowledgeable resource in a sometimes daunting industry. Another vital strategy is staying abreast of public market trends and asset management developments. With numerous asset managers and private equity firms like Goldman Sachs leading the charge in innovation, keeping the audience informed of market shifts and management tactics is key to remaining relevant. Engaging with content such as these not only demystifies topics like mutual funds and equity investments but also encourages informed decision-making among investors. Creating a dialogue around both public and private markets instills confidence in the influencer's services and reinforces their role as a bridge between complex financial data and practical application. Ultimately, a successful financial influence strategy will include actionable insights that guide fund investments and mitigate risks. By focusing on long-term capital growth and exploring a variety of funds and securities, influencers can enrich their audience’s understanding and ultimately enhance their investment portfolios. This ensures robust investor engagement and sustained interest within the dynamic world of asset management.The Role of Transparency and Ethics

The Importance of Upholding Ethical Standards

In the intricate world of asset management and public investing, keeping transparency and ethics at the forefront is crucial. Financial influencers, who hold sway over their audiences, play a pivotal role in shaping investment narratives and need to ensure their guidance aligns with ethical practices. As they navigate the complex landscapes of public markets and private asset management, their influence can directly impact investors' decision-making processes, from mutual funds to equity investments.

Building Trust through Transparency

Establishing trust with followers is paramount for influencers in the investment sector. Influencers can build credibility by being transparent about their affiliations with companies, funds, or investment services. For example, when discussing public or private markets, or endorsing asset managers, it is essential to disclose any professional relationships clearly. This fosters an open dialogue and reassures investors that the advice or insights they receive are authentic and unbiased.

Maintaining Ethical Boundaries

Given their influence, financial experts and influencers have a responsibility to maintain ethical boundaries. When discussing investment strategies or portfolio management related to asset classes such as real estate or fixed income, it is critical to provide unbiased information without undisclosed benefits. Ethical awareness helps protect investors from potential risks associated with misinformation about funds or securities.

Long-term Commitment to Ethical Practices

Ethical considerations become increasingly important as the lines between public investments and private equity continue to blur. Influencers must commit to long-term ethical practices, even as new trends and emerging markets evolve. From companies to individual investors, the financial ecosystem gains when influencing parties address potential risks and provide informed insights across portfolios managed under firms like Sachs Asset or Goldman Sachs.

Overall, transparency and ethical behavior are not merely requirements but essential components in steering the future of financial influence effectively. As influencers continue to navigate the evolving market landscapes, their adherence to these principles will ultimately solidify their authority and trustworthiness among investors and peers alike.