Understanding Distressed Debt

Grasping the Basics of Distressed Debt

Distressed debt represents a unique segment of the financial market, offering speculative investors opportunities to engage with securities that are under financial distress. This type of debt typically involves companies facing financial difficulties, often on the brink of bankruptcy or undergoing restructuring. Understanding the nuances of distressed debt is crucial for investors looking to capitalize on these high-risk, high-reward opportunities.

Investing in distressed debt requires a comprehensive analysis of the company's financial health and capital structure. Investors must be adept at identifying the signs of financial distress, which can include missed payments, declining revenues, or a deteriorating credit rating. The process of due diligence is vital in assessing the viability of investing in distressed securities.

Speculative investors often look for opportunities where they can purchase debt at a significant discount, with the potential for substantial returns if the company successfully reorganizes or restructures. This involves a deep dive into the company's financial statements, market position, and potential for recovery. The analysis strategies employed must be robust, incorporating both quantitative and qualitative assessments to gauge the potential for investment success.

In the United States, the market for distressed securities is well-established, with numerous case studies and real-world examples highlighting successful investment strategies. Investors often rely on verified sources and expert analysis to guide their decisions, ensuring they have a comprehensive understanding of the risks and rewards involved in distressed debt investing.

Key Indicators of Distressed Debt

Identifying Key Financial Indicators

When diving into the world of distressed debt, understanding the financial indicators that signal distress is crucial for speculative investors. These indicators provide insights into the financial health of a company and help in assessing the potential risks and rewards associated with distressed investing.

Financial Distress Signals

Several key indicators can reveal a company's financial distress. These include declining revenues, shrinking profit margins, and increasing debt levels. A thorough debt analysis often highlights these red flags, which can be critical in the decision-making process for investors.

Capital Structure and Credit Ratings

The capital structure of a company, including its mix of debt and equity, plays a significant role in its financial stability. A high level of debt compared to equity can indicate potential distress. Additionally, credit ratings from verified agencies provide a summary of a company's creditworthiness, offering another layer of analysis for investors.

Restructuring and Reorganization

Companies in financial distress often undergo restructuring processes to improve their financial standing. Understanding these processes, including reorganization strategies, is essential for investors looking to capitalize on distressed securities. This knowledge can guide strategic investment approaches and enhance the potential for successful outcomes.

For more insights into navigating the complexities of distressed debt investing, consider exploring resources on navigating the complex world of secondary advisory.

Analyzing Market Trends

Market Trends in Distressed Debt Investing

Distressed debt investing presents a unique landscape that is heavily influenced by prevailing market trends. Investors seeking opportunities in this area should conduct thorough financial and investment analysis to navigate the complexities of the market. Identifying which trends will impact their portfolios is crucial to strategic decision-making. Here's how these trends manifest in the markets:

- Economic Environment: Fluctuating economic conditions significantly impact distressed debt. Recessions often lead to increased opportunities as companies face financial difficulties, leading to potential restructuring and reorganization of their capital structures.

- Interest Rates: The interest rate environment can alter the risk profile of distressed securities. Changing rates impact the value and attractiveness of these investments, influencing speculative investor strategies.

- Regulatory Changes: Shifts in regulations related to bankruptcy laws and credit markets can either open up or narrow down investment avenues. Being informed about these changes allows investors to develop adaptive investment strategies.

- Emerging Markets: While investing in the United States remains popular, there is a growing interest in emerging markets as they offer potential high-reward opportunities. However, these also come with additional risks that require careful analysis.

- Technology and Data Analysis: Advances in technology and data analytics provide investors with enhanced tools for better debt analysis. The use of sophisticated models can lead to more accurate assessments of distressed debt’s potential returns and risks.

Staying informed about these market trends equips speculative investors with valuable insights to effectively allocate their capital. For more perspectives on strategic investment approaches in this domain, explore the role Palm Drive Capital plays in shaping such investments. Case studies further illustrate the real-world implications of these market movements and the efficacy of various investment strategies.

Risk Assessment Techniques

Risk Assessment in Distressed Debt Investing

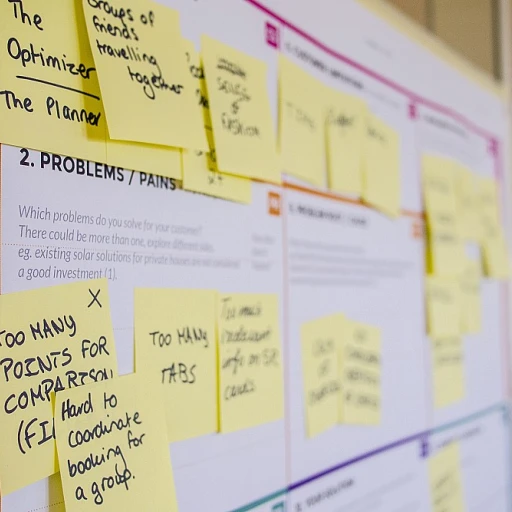

Analyzing distressed debt requires a comprehensive understanding of the risks involved. Speculative investors must be keenly aware of potential pitfalls in order to make informed decisions. Here's how you can evaluate these risks:- Financial Distress Evaluation: Begin by closely examining the financial statements of the distressed company. Understanding the capital structure is crucial, especially in identifying debt and equity proportions. This detailed debt analysis helps in gauging the severity of financial distress and estimating the company's potential for restructuring.

- Market Conditions: Keep an eye on prevailing market trends and conditions which can affect distressed debt securities. Market volatility can significantly impact the revenues and operational stability of distressed firms. Anticipating these changes can guide better investment decisions.

- Credit and Investment Ratings: Although distressed investing involves higher risk, it’s vital to rely on verified purchase insights and existing credit ratings as part of your analysis strategies. These ratings act as a guide to the potential recovery of the investment.

- Legal and Regulatory Aspects: Understand the reorganization and restructuring process under the legal framework in the United States, as this varies by jurisdiction. Proper comprehension of these elements can prevent unforeseen legal hurdles in the restructuring process.

Strategic Investment Approaches

Strategies for Maximizing Returns in Distressed Debt Investing

Navigating through the complex world of distressed debt investing requires a strategic approach tailored to maximizing potential returns. This part of the investment process involves sophisticated analysis strategies that assess both the current market conditions and the financial structure of the distressed securities.- Active Monitoring and Analysis: Crucial to successful distressed investing is the continuous monitoring of market trends and financial analysis to identify opportunities. Engaging in thorough debt analysis helps reveal potential shifts in the market that speculative investors can capitalize on.

- Capital Structure Optimization: Evaluating the capital structure is indispensable in determining the financial health of a distressed entity. Investors need to distinguish between debt and equity possibilities, ensuring that their strategic approaches align with the company’s capacity for restructuring or reorganization.

- Restructuring and Reorganization Tactics: In distressed debt scenarios, the restructuring process often serves as a turning point. Investors with adept knowledge in strategic investment approaches can play a significant role in aiding financial distress recovery through debt reorganization and private equity strategies.

- Risk Mitigation Techniques: Employing comprehensive risk assessment techniques is pivotal. Factors such as credit risk, economic downturn impacts, and the securities market's volatility must be critically evaluated to safeguard against potential losses.

- Verified Case Studies and Insights: Learning from verified case studies offers investors empirical insights into successful strategies in the United States market and beyond. Books like those available from Wiley Finance on distressed investing provide summary chapters that can be instrumental in refining investment strategies.

Case Studies and Real-World Examples

Industry Insights from Notable Case Studies

Exploring real-world scenarios of distressed debt investing can provide speculation investors with critical insights into the nuances of this complex market. Notable case studies offer a glimpse into how strategic decisions, in the face of financial distress, can lead to substantial returns or unfortunate setbacks.- Reorganization and Restructuring: Companies undergoing restructuring, often reshuffle their capital structure to alleviate financial burden. Analysis of such restructuring process reveals that the priority is usually to preserve equity while addressing critical debt obligations. This strategic move can be a beneficial investment if the reorganization leads to a stronger financial footing post-restructuring.

- Market Trends and Capital Movements: The market trends in the United States have shown varying patterns of distressed investing strategies over the years. By understanding the move towards private equity involvement, investors can better gauge when to buy distressed securities. Such cases emphasize the importance of capital flows in the timing of debt investing.

- Resolutions through Credit and Financial Instruments: In cases where negotiations between debt holders lead to an intricate restructuring of credit agreements, investors are often faced with crucial decisions. The process demands not only deep analysis strategies but also understanding the fundamental debt analysis to project potential outcomes.

- Strategic Investment Decisions: Reviewing decisions made by prominent firms engaging in distressed investing showcases varied approaches. Successful strategies often incorporate comprehensive analysis and resilient investment processes; these often are informed by market analysis and verified transactions.

- Lessons on Risk versus Reward: The risk assessment techniques applied by strategic investors illuminate the balancing act between risk and potential reward. Examining past projects where financial distress was both a hurdle and an opportunity provides speculative investors with a clearer summary of potential strategic outcomes.