The Intersection of Finance and Social Media

The Synergy of Finance and Social Media Platforms

In today's interconnected landscape, the confluence of finance and social media is reshaping how influencers impact capital markets and financial services. This intersection offers a unique opportunity to bridge the gap between content creation and investment strategies. Managed funds, encompassing alternative assets and financial data, are finding new pathways to engage with audiences through social media channels.

Global cities like London and Washington play pivotal roles in this dynamic, acting as hubs for both the financial sector and digital innovation. Asset managers are leveraging these platforms to access a diverse member base while influencers tap into data insights and asset management trends. The rise of alternative investments, be it private credit or other forms, is further fueled by this symbiotic relationship.

The establishment of associations and industry bodies focuses on ensuring that influencers adeptly navigate the complexities of investment management. These organizations advocate for the mutual benefit that can be derived from collaboration. With a keen eye on future alternatives, they prepare influencers to become informed partners.

To further explore how finance is reshaping influencer dynamics and understand the financial mechanisms in play, including investment management strategies that apply to social media, explore the differences between asset purchase agreements and stock purchases.

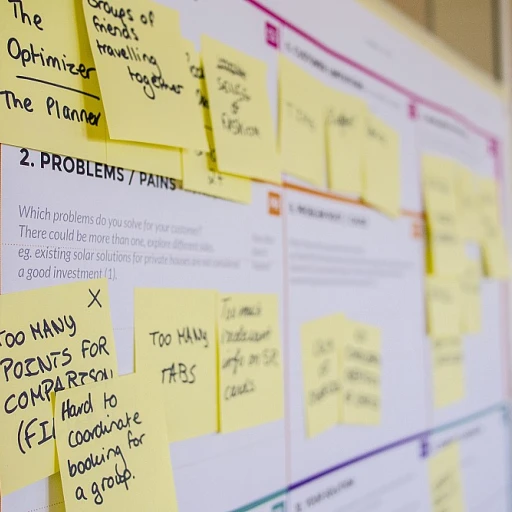

Challenges Faced by Influencers in a Financially Driven Landscape

Financial Hurdles for Influencers on the Rise

Influencers in the financial sector often navigate a complex landscape characterized by the ever-present need for financial literacy. Understanding the nuances of investment management, asset management and managed funds is essential. Associations like the Funds Association and organizations focused on alternative investment provide educational resources, yet the challenges remain significant.

Navigating Managed Fund Partnerships

Partnerships with managed funds or alternative asset firms require influencers to demonstrate credibility and trustworthiness. This involves not only producing engaging content but also adhering to regulatory standards set by bodies such as the European Commission and authorities in financial hubs like London and Washington.

Addressing Data-Driven Demands

In the age of data tech, influencers face pressures to incorporate data-driven insights into their content. This adds an additional layer of complexity, requiring skills traditionally reserved for finance professionals. Access to ops data and understanding capital markets can enhance the influencer's content strategy, but it also increases the need for dedicated financial education and resources.

Building Financial Expertise

Influencers must often resort to hiring financial experts or becoming summer interns to grasp the complexities of managed funds. Engaging with asset managers globally can provide valuable insights. Associations such as MFA Ops offer networking opportunities, but these come with their own costs and challenges.

Competitive Pressures in the Market

Given the lucrative potential of engaging with managed funds, competition among influencers is steep. Many seek partnerships with alternative fund managers or private credit firms to diversify income streams. The industry's competitive nature compels influencers to consistently innovate and enhance their financial acumen.

For those interested in the intricate financial arrangements that underpin influencer partnerships, understanding the differences between asset purchase agreements and stock purchases can provide additional clarity and leverage.

Opportunities for Influencers in Collaborating with Managed Funds

Building Bridges between Influencers and Financial Partners

The digital age has significantly expanded the horizons for influencers by offering unique collaboration opportunities with the financial sector, notably managed funds. As the role of social media influence grows, so does the potential for influencers to partner with these financial entities, creating a synergy that benefits both parties.

Financial organizations, particularly those in the realm of managed funds, private credit, and alternative investment, are increasingly seeking fresh, contemporary avenues to connect with their audience. Influencers present an innovative channel, tapping into diverse demographics and offering authentic engagement options. Through effective capitalizing on assets, influencers can leverage their reach, while asset managers can capitalize on broadened brand visibility.

Moreover, influencers stand to benefit from enriching content through collaborations with experienced asset management firms, boosting their credibility and authority in the financial sphere. By connecting with members of the funds association, influencers gain access to invaluable resources and insights, potentially revolutionizing their content strategy with an informed perspective on economic trends.

In today’s data-driven market, mutual growth is propelled by utilizing financial and ops data, enhancing strategic planning and execution. Asset managers are keen on engaging influencers who understand the nuances of financial services and can articulate these complexities to their followers effectively. In key global hubs like London and Washington, such collaborations are setting new precedents and creating industry benchmarks.

In conclusion, the symbiotic relationship between influencers and managed funds is becoming increasingly pivotal. By focusing on innovative strategies and embracing this evolving landscape, influencers can establish themselves as trusted voices in the realm of finance while exploring lucrative partnerships to foster sustainable growth.

Case Studies: Successful Partnerships Between Influencers and Managed Funds

Notable Collaborations That Set Precedents

Social media influencers and managed funds have forged impressive partnerships that highlight innovative synergies in today's dynamic financial landscape. Here are a few examples of successful collaborations:- Financial Education Campaigns: In a bid to educate the masses, asset management firms have collaborated with influencers to demystify complex financial products like hedge funds and private credit. These campaigns often feature influencers sharing candid experiences and insights on asset management, reaching audiences that might not otherwise engage with traditional marketing channels.

- Alternative Investment Promotions: Leveraging the credibility of influencers, financial services firms have effectively promoted alternative assets. Influencers typically provide a relatable voice, making the discourse around investment management more accessible and engaging for the average consumer interested in capital markets.

- Event Sponsorships and Intern Engagement: Fund associations and investment management entities have sponsored influencer events in major financial hubs like London and Washington. These collaborations often involve influencers engaging with summer interns and industry members, further bridging the gap between the financial community and the broader public through shared experiences and knowledge.

Strategies for Influencers to Attract Managed Fund Partnerships

Strategies for Influencers to Collaborate with Managed Funds

In the financially driven social media landscape, influencers can adopt several strategies to attract partnerships with managed funds. These partnerships can be mutually beneficial, providing influencers with financial backing while offering funds access to wider audiences. Here are some key strategies:- Understand the Landscape: Familiarize yourself with the financial services industry and become conversant with terms like asset management, managed funds, and alternative investments. Demonstrating knowledge in these areas enhances credibility and appeal to potential partnerships.

- Build a Financially Savvy Audience: Target and build an audience that fits the profile managed funds seek to reach. This means understanding the capital markets and creating content that educates your followers about investment management and financial strategies.

- Showcase Data-Driven Results: Highlight your ability to drive engagement through data analytics. Provide potential partners with insights into your audience's behavior and how this can benefit their investment strategies.

- Network with Key Industry Players: Attend industry events and connect with prominent asset managers and funds association members. Building relationships with key figures in the industry, such as those from financial hubs like London and Washington, can open doors to potential collaborations.

- Develop Tailored Content: Create content that is specifically targeted toward the needs and goals of managed funds. This includes collaborating on themed campaigns that align with global capital markets trends and the interests of asset managers.

- Leverage Industry Knowledge: Stay informed about current and future trends in the influence space, such as the move towards alternative assets like private credit. Understanding industry shifts can position you as an influencer who provides valuable insights and aligns with evolving investment goals.

Future Trends: The Evolving Role of Managed Funds in Social Media

Emerging Dynamics in Managed Funds and Social Media

The relationship between managed funds and social media is progressively evolving, introducing new paradigms and creating future opportunities in the ever-expanding digital landscape. The global scene, from London to Washington, is witnessing significant transformations as alternative investment options and asset management practices adapt to digital tools. Influencers need to prepare for shifts in asset management as data technology integrates into the financial services sector. Asset managers are increasingly using data tech to inform their decisions, improving the ability to share and manage information efficiently. This empowers influencers to leverage these advancements to attract partnerships with managed funds.- Data-Driven Decisions: The use of data technology in asset management is becoming standard. Influencers familiar with ops data can position themselves as valuable partners to managed funds seeking innovative ways of engaging with different demographics.

- Capitalizing on Alternative Investments: There is an increase in interest in alternative investments like hedge funds and private credit within the financial services industry as they offer unique opportunities for growth. Understanding these alternatives can help influencers align their strategies with the evolving investment preferences of asset managers.

- The Role of Industry Associations: Organizations, such as funds association counterparts in the United States and the European Commission, are driving changes in financial policies that impact the sector globally. Keeping abreast of these shifts allows influencers to stay relevant and informed, aiding their strategy to collaborate with managed funds.