The Role of Social Media in Investment Decisions

The Powerful Role of Digital Platforms

Social media platforms have become pivotal in shaping investment decisions. The ability to reach vast audiences has transformed the landscape for modern investors. From fund insights and portfolio strategies to equity trends, the wealth of information available online is extensive and often instantaneous.Impact on Decision-Making

Investors across the United States, particularly in bustling markets like Chicago, leverage digital content to fortify their investment choices. The information shared by influencers, whether about private equity, hedge funds, or real estate investments, often arms investors with a deeper understanding of the dynamic environments they operate in. Aspiring influencers need to comprehend how social media directly impacts investment management decisions. This understanding aids in crafting meaningful content, guiding investors in constructing robust portfolios. To explore how leadership and strategic decision-making intertwine with social platforms, delve into this insightful analysis of social media's interaction with leadership in investing.Navigating the Investment Ecosystem

It’s crucial to acknowledge the interplay between emerging financial services and digital influence. Whether discussing a significant capital movement or funds managed by renowned companies in Chicago Illinois, the insights provided by seasoned influencers may empower investors with strategic foresight, enriching their decisions in both public and private markets.William Harris: A Case Study in Influencing Investors

William Harris: A Revolutionary in Financial Influence

William Harris has carved a notable reputation within the financial sector, leveraging social media as a powerful tool to influence modern investors. Based in Chicago, Illinois, and with deep ties to the landscape of investment management, his strategies emphasize transparency and accessibility, resonating with a broad audience across various platforms. Harris is associated with multiple entities, including WHI Private Equity, a fund llc, and other private equity firms. Here, as a portfolio manager and vice president, he harnessed the reach of social media to engage with both novice and seasoned investors. One might wonder how Harris manages to stand out in a crowded digital space. The secret lies in his adept use of financial storytelling. By breaking down complex concepts into digestible narratives, he empowers his followers, providing insights into equity management, AUM analysis, and capital growth tactics. If you’re keen to learn more about this approach, there's an excellent deep dive into the art of social influence that highlights the importance of storytelling in establishing a strong online presence. While managing millions in assets, Harris brings a personal touch to his interactions. He showcases real-life scenarios from his management experience, offering transparency that builds trust, a critical element discussed later. His ability to connect with diverse investors, from those interested in hedge funds to venture capital in real estate, underscores his influence in the United States’ financial services sector. In Chicago, where competition among fund managers and companies is fierce, WHI and the Harris family have continued to set high standards for investment services. His influence extends beyond local boundaries, making him a key figure in modern investment strategies and decisions.Challenges Faced by Influencers in the Financial Sector

Overcoming Hurdles in a Digitally Dynamic Sector

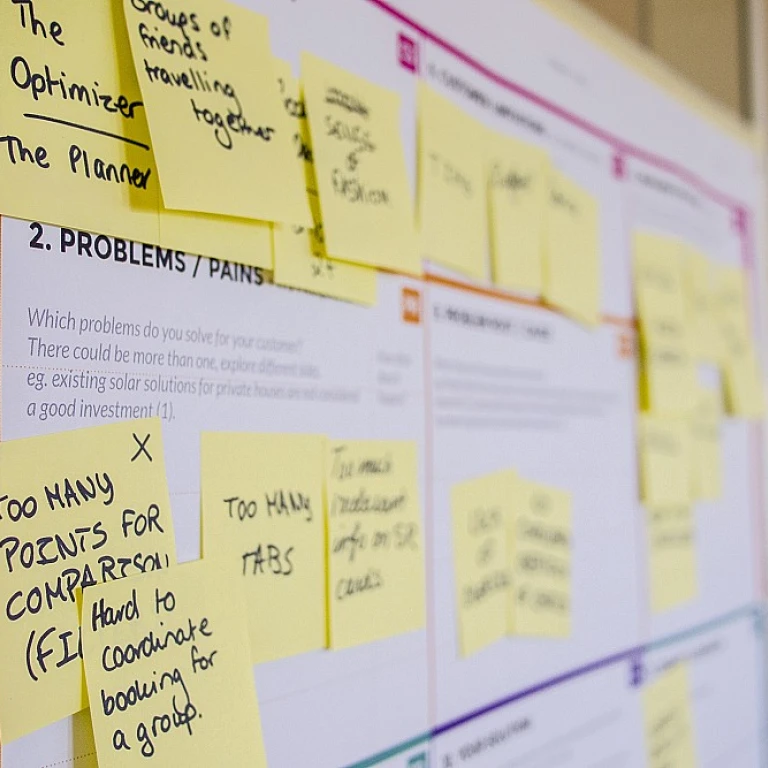

In the rapidly evolving sphere of finance, influencers encounter several challenges while trying to leave a mark. This industry is defined by its complexity and requires a high level of understanding to effectively communicate with potential investors. William Harris, based in Chicago, Illinois, exemplifies how the fusion of financial acumen and media savvy can bolster one's influence in the investment landscape. One major obstacle is the sophisticated nature of financial services and investment strategies. With the rise of fund management, including private equity and hedge funds, influencers must possess a deep understanding of portfolio management. Their content should not only engage but educate audiences about the nuances of asset management, private funds, and the intricacies of capital allocation. Additionally, the financial sector operates under strict regulatory oversight, especially in the United States. Influencers must navigate these regulations carefully, ensuring they comply with guidelines while offering valuable insights to their audience. Trust and credibility are crucial, as followers rely on influencers for sound financial advice. Therefore, overcoming these hurdles requires a fine balance between sharing knowledge and adhering to compliance standards. Another challenge is the potential impact of misinformation in social media spaces. Influencers like those from Harris Investors must actively work to debunk myths and provide verified, accurate information. This reinforces their authority in the field, ensuring their advice is respected and valued. Echoing the experiences of other influential figures in the finance world, creating a strong digital presence while maintaining professionalism is essential for success. Overcoming these hurdles calls for continuous learning and the ability to adapt to an ever-changing digital environment.Building Trust and Credibility Online

Strategies to Build Trust and Establish Credibility in the Financial Sector

In the competitive world of social media, gaining the trust of your audience is paramount, especially when it pertains to financial advice. Influencers like William Harris, who have mastered the art of influence, demonstrate key strategies that bolster transparency and credibility in investment discussions. To build an honest relationship with your audience, consider the following approaches:- Transparent Communication: Clearly articulate your affiliations with any financial services or products. If you’re discussing an AUM or management investment, ensure your audience knows your connection to the subject, be it a management role or a fund relationship. Honest disclosure builds trust.

- Authentic Content: Engage your audience with genuine insights. Whether it’s about hedge fund strategies or private equity trends, your personal experiences and unique perspectives can resonate more deeply with followers.

- Consistent Quality: Regularly providing valuable content around asset management and the latest in fund dynamics contributes to your credibility. Drawing from real estate experiences or discussing capital trends in Chicago can further establish you as a seasoned voice in the investment space.

- Data-Backed Insights: Use data and case studies to substantiate your claims. Discuss William Harris’s influence accurately by sharing factual information on how investment decisions in Chicago or across the United States were impacted.

The Future of Social Media Influence in Finance

The Evolving Landscape of Financial Influence

The future of social media influence in finance is poised for significant transformation. As platforms evolve, influencers in the financial sector must adapt to maintain their relevance and impact. The integration of advanced technologies and data analytics is reshaping how financial advice is disseminated and consumed.

Embracing Technological Advancements

With the rise of artificial intelligence and machine learning, influencers can now offer more personalized and data-driven insights. These technologies enable influencers to analyze vast amounts of data, providing investors with tailored advice that aligns with their unique investment goals. This shift not only enhances the value of the content but also strengthens the trust between influencers and their audience.

Regulatory Considerations

As the influence of social media in finance grows, so does the scrutiny from regulatory bodies. Influencers must navigate a complex landscape of regulations to ensure compliance while maintaining their authenticity. This involves understanding the legal implications of financial advice and ensuring transparency in all communications.

Building a Diverse Portfolio of Content

To stay ahead, influencers need to diversify their content strategies. This includes exploring new formats such as podcasts, webinars, and live Q&A sessions. By offering a variety of content types, influencers can engage with a broader audience and cater to different learning preferences.

Collaboration with Financial Institutions

Partnerships with established financial institutions can enhance an influencer's credibility and reach. By collaborating with banks, investment firms, and other financial services providers, influencers can access a wealth of resources and expertise. This collaboration can lead to the development of innovative financial products and services that meet the evolving needs of investors.

As the financial landscape continues to change, influencers who embrace these trends will be well-positioned to lead the charge in shaping the future of investment advice. By staying informed and adaptable, they can continue to provide valuable insights to investors across the United States and beyond.

Practical Tips for Aspiring Financial Influencers

Stepping Stones for Future Finance Influencers

Aspiring financial influencers have immense potential to shape the world of investments, similar to the impact seen with prominent figures in the sector. Here are some practical tips to help navigate this competitive field:- Education and Expertise: A solid grounding in finance is essential. Whether you're focusing on fund management, private equity, or real estate, continuous learning about investment strategies, market trends, and financial regulations helps build credibility.

- Networking with Established Figures: Connecting with experienced portfolio managers and vice presidents within financial services can provide invaluable insights. Events, both in Chicago and across the United States, offer opportunities to meet influencers like those in fund LLCs or private equity sectors.

- Consistent Content Creation: Like the case of influential figures from Chicago, maintaining a consistent flow of relevant content around capital management or investment portfolios is crucial. This keeps your audience engaged and positions you as a thought leader.

- Focus on Transparency: Building trust demands transparency. Sharing portfolio management practices and performance, similar to the transparency expected of hedge funds and private equity managers, boosts credibility.

- Understand Your Audience: Tailoring your message to suit different investor segments, from private individuals to institutions, ensures more effective communication. This helps in resonating with investors, from newcomers to seasoned fund managers.

- Leverage Digital Platforms: Maximize the use of platforms that suit your style and content. Whether through instructional videos on YouTube or analyses shared on LinkedIn, choose what best conveys your expertise.