Understanding AI in Real Estate Due Diligence

Exploring the Role of AI in Real Estate Due Diligence

In recent years, advancements in artificial intelligence have revolutionized various sectors, and real estate is no exception. AI-powered due diligence is transforming the way that real estate agents, investors, and companies handle complex transactions. This shift towards automation and advanced data analysis tools has enabled stakeholders to make more informed decisions, minimizing risk and optimizing the efficiency of the diligence process. The integration of AI in estate diligence allows for the automation of several tasks traditionally handled by human experts. By utilizing machine learning algorithms, AI systems can scan and analyze large sets of data in real time, providing crucial insights into market trends, compliance requirements, and potential financial risk assessments. Notably, AI can handle the processing of large volumes of documents with remarkable precision, saving time and reducing the chance of human error in m&a diligence and private equity transactions. Further enhancing the due diligence process, AI ensures that all compliance documents are meticulously reviewed and analyzed. Specialized diligence software allows for the deployment of data rooms and powered diligence tools that can compile and process information quickly. Consequently, this process automation facilitates a more streamlined approach to risk assessment and decision making in commercial real estate transactions. To address the increased complexity that AI introduces into this process, many market leaders in real estate are investing in developing AI solutions that strike a balance between automation and human insight. This collaboration between machine efficiency and human expertise is vital in achieving thorough estate diligence, enhancing decision-making capabilities, and ultimately driving better outcomes in real estate transactions. For a deeper dive into the transformative trends shaping real estate and AI, along with insights into the financial landscape's impact on influencer strategies, consider exploring how new funding models are unveiled in the realm of titanium funding. This exploration could provide a broader understanding of the importance of incorporating technology in real estate ventures.The Impact of AI on Influencer Strategies

Transforming Influencer Strategies with AI

The integration of artificial intelligence in the realm of real estate due diligence marks a significant shift in how influencers, particularly in the real estate sector, structure their strategies. With AI-driven diligence software amalgamating data and providing real-time insights, influencers now have access to a wealth of information that can refine their content creation approach.

Incorporating machine learning algorithms, these AI tools facilitate a more streamlined diligence process by automating complex data analysis and providing agents with actionable insights. This not only enhances the depth and accuracy of content but also enables influencers to present information that resonates with market trends and the ever-evolving landscape of commercial real estate.

Real-time data rooms and enhanced document automation tools have revolutionized the approach to content generation, enabling influencers to align their messaging with compliance and risk assessment benchmarks. Such technologies empower influencers to make informed decisions, backed by substantial real estate analysis, which ultimately builds credibility and trust among their audience.

With automated agents conducting thorough diligence, the possibility of risks associated with human error diminishes, thus providing influencers with the confidence to endorse processes and businesses that have undergone rigorous AI-powered diligence. This trust factor is crucial, especially when framing discussions around intricate topics like private equity and m&a diligence.

Moreover, as AI in real estate continues to evolve, influencers have the unique opportunity to stay ahead of industry shifts by harnessing these technologies. By leveraging insights from AI-driven document processes and market analysis, influencers can maintain their relevance in the sector while simultaneously driving engagement and reach.

For a deeper dive into how AI has impacted influencers in various sectors, including energy ventures, you can explore this comprehensive analysis.

Leveraging AI Tools for Enhanced Content Creation

Transforming Content Creation Through AI Tools

Capitalizing on AI-driven resources can significantly enhance content production for real estate influencers. By integrating diligence software and data rooms, influencers can streamline the process of gathering essential insights and market trends, making content creation more efficient. Leveraging machine learning and automation tools enables influencers to analyze large datasets in real time, offering valuable insights into the estate diligence process. For instance, AI-powered tools can process complex estate documents quickly, helping influencers present informed and engaging content to their audience. Here's how diligence tools are making a difference:- Automation Agents: These tools automate repetitive tasks, reducing the time spent on data analysis and allowing more focus on creative content.

- Risk Assessment: AI tools assess potential risks in financial and market analysis, presenting influencers with data-driven recommendations.

- Improved Accuracy: Influencers can rely on AI to minimize human error, ensuring that their content is both accurate and compliance-ready.

Addressing Ethical Concerns with AI in Real Estate

Ensuring Ethical Implementation of AI in Real Estate

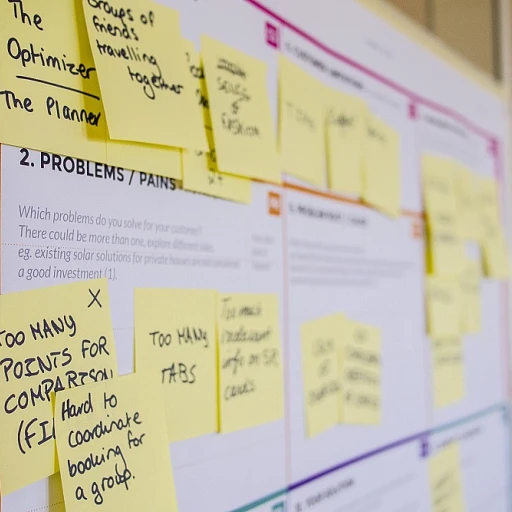

The incorporation of artificial intelligence in real estate transactions calls for careful consideration of ethical concerns. As technology continues to evolve, stakeholders—ranging from real estate agents to buyers and sellers—must remain vigilant about the ethical implications of AI-powered diligence tools.One of the main ethical considerations is data privacy. In handling large volumes of sensitive information throughout the estate diligence process, it is crucial to establish robust data protection measures. AI systems must ensure they comply with existing data privacy regulations to safeguard personal and financial information. This includes implementing end-to-end encryption within data rooms and using compliance checks to maintain trust among parties.

Furthermore, there's the challenge of bias in AI algorithms. AI systems, which often rely on past datasets, can inadvertently learn and perpetuate biases, affecting decision-making processes. Stakeholders need to regularly audit and review these algorithms for fairness and accuracy in risk assessment and analysis activities.

The automation of tasks traditionally managed by humans, such as document processing and financial analysis, also raises fears of job displacement among agents and professionals involved in the diligence process. An ideal approach emphasizes automation agents as tools to augment human expertise, thus enhancing efficiency without replacing the indispensable human element of critical thinking and negotiation.

Finally, providing comprehensive transparency and accountability within AI-driven transactions is key. Stakeholders should clearly understand how AI influences decisions, such as risk assessments or market trend analysis, ensuring an open and accountable diligence process.

Addressing these ethical concerns effectively not only fosters trust among parties but also strengthens the transformative potential of AI in reshaping real estate practices.

Case Studies: Successful AI Integration in Real Estate

Real-World Applications of AI in Estate Diligence

Artificial intelligence has proven to be a game changer in real estate, especially in the estate diligence and transaction processes. The integration of AI-powered diligence enables agents to carry out more efficient and precise risk assessments, proving beneficial in both commercial and residential property markets. One notable outcome of AI integration is the automation of document analysis during due diligence. In traditional processes, evaluating critical documents such as financial statements, compliance records, and title deeds required substantial manual effort and time. Today, with diligence software, AI can scrutinize data at a much faster rate, allowing professionals to concentrate on high-level analysis instead of mundane tasks. AI tools also assist in automating data room management, improving the decision-making process by providing real-time insights from vast datasets. With the reduction in human errors and accelerated data processing, AI enhances the potential for seamless transactions. This improvement in process automation translates into real savings in both time and financial resources. Ethically, the aim is to balance technology-driven transparency with the need for human oversight. These tools, when correctly leveraged, ensure compliance with regulatory standards and mitigate the risks associated with potential bias inherent in machine learning algorithms. To exemplify successful integration, consider private equity firms that have adopted automated diligence tools. They leverage artificial intelligence to optimize mergers and acquisitions (M&A) diligence. By employing process automation, these firms effectively reduce risks and gain a competitive edge in market trends analysis. In essence, the adoption of AI in real estate acts as a catalyst, enhancing operational diligence while safeguarding compliance and minimizing potential risks. Through the intelligent use of these advancements, real estate agents and investors can unlock new levels of efficiency, supporting sustained growth and the evolution of industry standards.Future Trends: AI and Real Estate Influence

The Evolving AI Landscape in Real Estate Transactions

The integration of artificial intelligence in real estate continues to revolutionize the diligence process by offering real-time data analysis, risk assessment, and automation solutions. As the landscape evolves, these advancements not only reshape how estate diligence is conducted but also influence market trends and agent strategies.

AI-powered diligence tools offer agents improved compliance and efficiency in handling voluminous documents. Automation agents streamline the diligence process, allowing real estate professionals to focus on critical decision-making rather than manual document analysis. This capability is particularly beneficial for commercial real estate transactions and m&a diligence, where precise, timely insights are crucial.

Transforming Real Estate with AI Insights

AI has the potential to generate valuable data insights that aid in thorough risk management and financial planning. Machine learning algorithms sift through data rooms to provide agents with compliance and risk-related insights that were previously unattainable through traditional methods.

As AI aids in understanding complex data, human agents are empowered to make more informed decisions. This marriage of AI and human analysis not only reduces processing time but also mitigates potential risks associated with human error, fostering a more secure transaction environment.

Preparing for the Future of AI in Real Estate

Looking ahead, the future of AI in real estate will likely see more sophisticated tools that enhance both due diligence and market analysis. Agents will require continual adaptation to new tools, such as improved diligence software and smarter data room solutions, to stay relevant in a technology-driven market.

As process automation becomes more mainstream, real estate professionals must weigh the balance between automation and human oversight to ensure compliance and ethical integrity in their transactions. By continually updating their skill sets and embracing data-driven insights, agents can harness AI's full potential, ultimately transforming the way real estate is conducted.