Understanding European Fund Administration

Comprehending the Fundamentals of European Fund Administration

European fund administration is a crucial segment in the broader landscape of financial services, dedicated to the management and oversight of investment funds. This domain arches over a myriad of tasks ranging from fund accounting and reporting to compliance and regulatory requirements. Predominantly located in financial hubs like Luxembourg, the administration of funds has evolved into a sophisticated operation that integrates cross-border solutions to cater to the diverse needs of investors globally. Fund administration in Europe is not merely about the routine maintenance of investment funds. It encompasses a wide spectrum of activities designed to ensure the accurate and efficient management of private and alternative investment vehicles, such as private equity and real estate, within a regulated environment. The administrative process involves engagement with various stakeholders including asset managers, financial companies, and investment groups throughout the European continent. A significant facet of fund administration includes the precision in data management and reporting, pivotal for decision-making processes and maintaining transparency. Platforms and systems dedicated to the administration of funds often deliver global asset servicing solutions, tailored to the dynamic demands of an ever-evolving industry. In the context of private asset management and fund services, European administrators undertake extensive responsibility in asset servicing and the transaction of information between entities. This domain is further enhanced by the collaboration with universal investment companies and transfer agencies, creating an efficient ecosystem aimed at maximizing return on investment. As the financial industry advances, the integration of modern technology and social media platforms emerges as a potential influencer in enhancing the effectiveness and reach of fund administration services. This influence of social media in financial services opens avenues for both challenges and opportunities, underscoring the dynamic nature of the European financial landscape.The Role of Social Media in Financial Services

The Digital Renaissance in Financial Services

The past decade has seen a seismic shift in how businesses operate across various sectors, and the financial services industry is no exception. The integration of social media platforms has revolutionized the landscape of fund administration and investment management. It provides an unprecedented avenue for real-time communication and insights, bridging the gap between fund managers, investors, and financial service providers.

Social media is profoundly impacting the way we perceive European fund administration. In a world where businesses like efa European and universal investment groups operate in a highly competitive environment, social media becomes a vital tool for engagement and outreach. It allows these entities to communicate their brand values, showcase their fund administration services, and highlight their investment strategies effectively.

Leveraging Digital Platforms for Enhanced Engagement

Financial companies and private equity groups are increasingly leveraging social media to enhance their brand presence globally and support their fund services. These platforms serve as rich troves of data and market insights that can influence investment decisions and strategies. By utilizing digital solutions, fund managers and asset management firms can improve client engagement and offer real-time reporting on fund performance, a critical feature in today’s fast-paced financial ecosystem.

Social media also opens new opportunities for communicating complex financial information in more accessible ways, which is crucial for an industry that handles diverse asset classes like real estate, cross-border investments, private markets, and alternative investment vehicles. By crafting tailored content, financial service entities and asset services groups can better meet the needs of their stakeholders, enhancing transparency and trust.

Transforming Traditional Financial Channels

The intersection of traditional financial services with modern digital channels challenges fund administration companies to innovate. As the global fund administration sector, including those operating out of Luxembourg, evolves, social media becomes not only an outreach tool but also a feedback mechanism. It enables direct interaction with investors, refining customer service and ensuring that clients have access to the full spectrum of fund solutions available, from transfer agency to comprehensive asset servicing.

The discussion on how social media influences investment funds is not complete without acknowledging the importance of regulatory frameworks, which play a significant role in merging these platforms with financial objectives. However, as the industry trends towards increasing integration of digital and traditional channels, the focus remains on enhancing service delivery and client satisfaction.

Influencers in the Financial Sector

Navigating the Influence of Tastemakers in Financial Domains

Influencers have become pivotal in shaping the perceptions and decisions within the financial industry, particularly in the domain of European fund administration and investment management. Their ability to connect directly with audiences confers them a potent role in disseminating crucial information about funds and investment strategies. The presence of influencers in financial services brings a layer of relatability and accessibility to often complex topics such as fund management, asset servicing, and investment fund structures. Platforms like Twitter, LinkedIn, and industry-specific blogs provide a stage where financial influencers can share insights on fund administration, offer investment advice, and demystify the intricacies of cross-border asset management.- Creating Value Through Expertise:

- Influencers with deep knowledge and experience in sectors like private equity, alternative investment, or real estate can guide audiences through the nuances of European fund and asset management.

- They often use data-driven insights and global industry trends, providing a level of depth that resonates with both individual investors and fund managers.

- Building Trust and Authority:

- Established influencers in the financial sector often collaborate with reputable firms such as those located in Luxembourg, a key hub for European fund administration.

- Engaging with trusted influencers can enhance a company's credibility, especially for new solutions or universal investment opportunities.

- Enhancing Engagement with Innovative Content:

- Through interactive content like webinars, live Q&A sessions, and personalized investment solutions, influencers increase engagement, making subjects like transfer agency and asset management more approachable.

- They explore new paradigms, including private markets and digital transformation in fund reporting and EFA European solutions.

Challenges in Merging Social Media and Finance

Integrating Social Media and Finance: Challenges on the Horizon

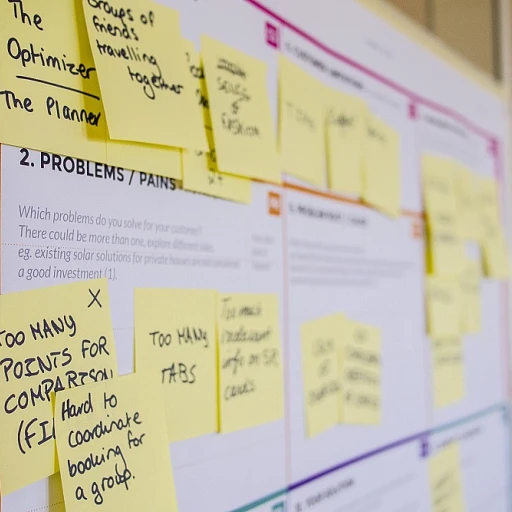

The intersection of social media and fund administration is reshaping how financial services communicate and operate. However, blending these two worlds presents unique hurdles that asset managers and financial companies must navigate carefully. One major challenge is ensuring data privacy and protection. As financial institutions like efa european navigate the digital landscape, they must uphold rigorous standards for safeguarding sensitive information, both for individual funds and comprehensive asset management strategies. Social media platforms, while effective for outreach, require careful data management solutions to meet regulatory demands. Another obstacle involves maintaining consistent and compliant messaging. Fund services and asset management firms operate under stringent regulations, particularly in cross-border contexts like Luxembourg, a key player in European fund administration. Tailoring social media content to meet the diverse regulatory landscapes can stretch resources, requiring dedicated teams or collaboration with local experts who understand the intricate legal requirements. Moreover, there is a balancing act between engaging the audience with impactful content and sticking to the factual and cautious communication style often expected in financial reporting. Financial services must craft content that reflects authority while remaining relatable, a task that often challenges traditional fund managers and global investment group leaders accustomed to more formal modes of communication. Emerging technologies present another layer of complexity. As digital tools evolve to offer innovative ways to engage, financial companies must assess the impact of these on their existing frameworks of private equity investment and real estate asset management. The universal investment landscape is also broadening as alternative investment funds seek visibility and credibility across various platforms, adding another dynamic to the traditional fund administration systems. These challenges demand a multifaceted approach from the asset servicing industry—a strategy that incorporates effective use of data, robust regulatory compliance, and a keen understanding of social media dynamics. Encouragingly, many European fund companies are adapting, exploring new methods to keep pace with social media advancements while maintaining their roles as trustworthy stewards of alternative investment capital and private asset management.Regulatory Considerations for Influencers

Navigating the Regulatory Landscape for Social Media Influencers in Finance

As the digital world continues to evolve, influencers in the financial sector must be astutely aware of the regulatory framework surrounding their online activities. With fund administration playing a key role in the European asset management landscape, it is crucial for influencers to leverage social media responsibly, both to remain compliant and to protect their audience.

In the context of European fund services and administration, governments and regulatory bodies prioritize transparency and accountability. Compliance requirements become particularly stringent when dealing with cross-border investment funds and efa european services, where regulations can vary significantly between jurisdictions. Whether discussing private equity, universal investment strategies, or the roles of asset managers, influencers must ensure accuracy and compliance in their content.

Financial services influencers should be well-versed in the regulations governing alternative investment products, investment funds, and fund managers. As these influencers are often perceived as authorities by their followers, they play a vital role in shaping the public’s understanding of complex financial subjects. The integrity of this information becomes especially critical when handling reporting and data for real estate and private asset investments.

One of the major challenges in merging social media platforms with financial advisory is the risk of spreading misinformation. This emphasizes the importance of adhering to a code of conduct, especially when providing advice on fund management, asset services, or asset servicing solutions. Trustworthiness can be maintained by aligning content with the guidelines provided by financial regulatory authorities, such as the European Securities and Markets Authority (ESMA).

Furthermore, to mitigate potential legal repercussions, influencers should be familiar with the regulations specific to their jurisdiction, including any changes in reporting requirements for fund managers and investment companies. In particular, those operating within Luxembourg’s lucrative private markets and global financial services industry must carefully navigate the complexities of asset servicing legislation.

Overall, as social media continues to intersect with finance, understanding and adhering to regulatory considerations is not just an obligation but a necessity. By fostering transparency and compliance, influencers can effectively contribute to the trust and credibility of the financial industry.