Understanding Private Equity Marketing

Decoding the Dynamics of Private Equity Marketing

Private equity marketing is a specialized field that requires a deep understanding of both the financial landscape and the nuances of digital engagement. At its core, it involves promoting private equity firms and their investment opportunities to potential investors, including institutional investors and high-net-worth individuals. This marketing strategy is distinct from traditional marketing approaches due to its focus on long-term relationships and the complex nature of the asset class.

Private equity firms often rely on a mix of digital marketing strategies to reach their target audience. These strategies include content marketing, email marketing, and leveraging social media platforms to build brand awareness and trust. The goal is to effectively communicate the value proposition of the equity fund or firm, showcasing successful portfolio companies and demonstrating the potential for high returns on investment.

In recent years, the role of social media in private equity marketing has grown significantly. Social media platforms offer a unique opportunity for equity firms to engage with a broader audience and present their investment opportunities in a more accessible manner. By utilizing search engine optimization and engaging content, firms can enhance their visibility and attract potential investors.

For those interested in exploring how social media can amplify their marketing efforts, understanding the power of influencer hashtags can be a game-changer. This approach not only boosts visibility but also fosters a sense of community and engagement among potential investors.

The Role of Influencers in Private Equity

Influencers Elevating the Private Equity Landscape

In the contemporary landscape of marketing, influencers have redefined how information circulates, not only impacting sectors like fashion or lifestyle but also niche domains like private equity. These digital era mavens play a significant role by amplifying the reach and visibility of private equity firms in the vast ocean of social media networks. Here’s how influencers are pioneering new opportunities for equity marketing.

Navigating Complex Investment Narratives

Influencers in the private equity space are experts in simplifying intricate concepts for their informed followers. By crafting engaging content that highlights the benefits of investing in equity funds, influencers help demystify complex investment strategies. This makes private equity investments more approachable for both retail investors and institutional investors, who may invest substantial capital into promising portfolio companies.

Building Brands and Trust

Trust plays an integral role in converting potential investors into committed stakeholders. Influencers foster this trust by sharing real-life success stories and case studies, demonstrating how equity firms have effectively grown their investment portfolios over time. Their authentic social media presence helps cultivate a brand image that resonates with long-term investors, both in the United States and beyond.

Enhancing Digital Marketing Efforts

By leveraging their expansive reach, influencers effectively supplement a firm's digital marketing strategies. Through strategic email marketing campaigns, engaging blogs, and well-curated social media posts, influencers drive engagement and push potential investors through the marketing funnel. Their efforts ensure that a brand's marketing strategy aligns with the latest market trends, hence optimizing the equity firm’s exposure to a targeted audience.

Challenges Faced by Influencers in Private Equity Marketing

Navigating the Complexities of Private Equity Marketing

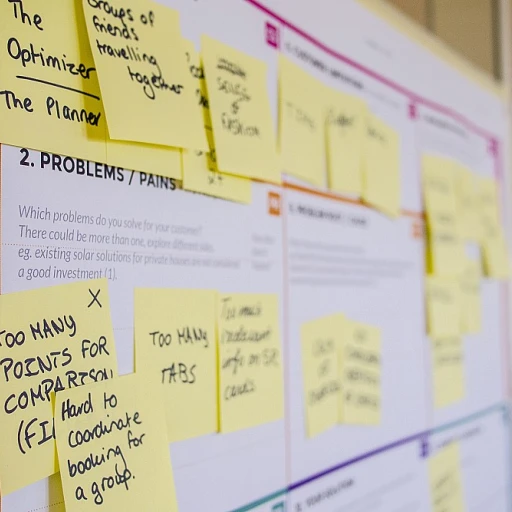

When it comes to serving the intricate needs of private equity marketing, influencers face a unique set of challenges. Unlike traditional consumer markets, private equity firms deal with an audience that’s less about sheer numbers and more about targeted, high-value connections. The private equity sector requires influencers to deliver content that resonates deeply with both firms and their sophisticated investor base.- Sensitive Information: Private equity often involves dealing with sensitive, confidential information. Influencers must navigate sharing compelling content without breaching confidentiality or regulatory requirements. This careful balance is crucial in maintaining trust and authority within the market.

- Complex Ecosystem: The ecosystem is complex, involving various stakeholders such as investors, portfolio companies, and capital managers. Influencers must develop a deep understanding of how each piece fits within the broader investment landscape to develop effective communication strategies.

- Regulatory Hurdles: Given the regulatory landscape around financial services, influencers face the challenge of ensuring that their marketing strategies meet compliance and legal standards. This includes adhering to guidelines that might restrict certain promotional activities.

- Engaging Content Creation: Crafting content that is not only informative but also engaging can be difficult given the technical nature of private equity. Influencers must work toward simplifying complex investment concepts to enhance understanding and appeal among their audience.

Strategies for Successful Private Equity Campaigns

Maximizing Impact Through Innovative Approaches

Navigating the dynamic landscape of private equity marketing requires an arsenal of strategies tailored for success. Today's influencers are not just content creators; they're key players in shaping perceptions and driving investor engagement. A successful private equity campaign involves multiple components that work seamlessly together.- Content as the Core: At the heart of any marketing strategy is content that resonates. Influencers need to craft compelling narratives around portfolio companies, equity funds, and investment opportunities. By highlighting unique value propositions and growth potential, they can attract and maintain the interest of potential investors, ranging from institutional investors to venture capital enthusiasts.

- Digital Engagement: Leveraging social media platforms allows for direct engagement with a broad audience. Whether it's through engaging videos, insightful articles, or interactive webinars, influencers can communicate the value of private equity investments in a more relatable manner. Utilizing digital marketing tactics, such as email marketing and search engine optimization, further extends the reach of these campaigns.

- Analytical Backing: It's crucial to support claims with data. Incorporating case studies and analytical insights can demonstrate past successes and projected growth. This not only builds credibility but also reassures investors about the asset class they are considering.

- Adaptive Strategies: The private equity landscape is ever-evolving, and so should be the strategies employed. Influencers, equity firms, and marketers must stay ahead by continuously adapting to market trends and investor sentiment. Flexible approaches enable quick pivots in response to changing investor interests and market dynamics.

Measuring Success in Private Equity Marketing

Evaluating Impact and Performance Metrics

In the dynamic sphere of private equity marketing, understanding success is paramount, especially when social media and content marketing intersect with the intricacies of investment and capital. By establishing clear evaluation metrics, firms can effectively gauge the performance of their marketing strategies. Key Performance Indicators (KPIs) Setting relevant KPIs is essential. For private equity firms, these might include:- Engagement Rates: On social media, likes, shares, comments, and mentions provide insights into how content resonates with the audience.

- Investment Leads: Tracking inquiries from potential investors generated through campaigns can indicate success in attracting interested parties.

- Brand Visibility: Measuring growth in brand mentions, media coverage, and followers across various platforms highlights increased visibility.

- Email Marketing Metrics: Open rates, click-through rates, and bounce rates offer insights into a firm's email marketing effectiveness.

- Search Engine Results: Improved rankings for targeted search terms can indicate successful digital marketing efforts.

- Social Media Analytics: Platforms like Facebook Insights, LinkedIn Analytics, and Twitter Analytics offer data on audience demographics, post performance, and trends over time.

- Google Analytics: Essential for website performance tracking, it provides data on traffic sources, behavior flows, and conversion rates, helping refine marketing strategies.

- CRM Systems: Customer relationship management systems can track the progression of leads generated through campaigns, providing insights into the investor journey.