The Intersection of Finance and Social Media

Bridging the Gap: Finance Meets Social Media

The convergence of finance and social media is reshaping the landscape of influence. As platforms evolve, so does the role of financial entities like Crestline Investors, who are increasingly becoming pivotal players in this space. Their involvement is not just about providing capital but also about leveraging their expertise in investment management to foster growth and innovation among influencers.

In the bustling hub of Fort Worth, Texas, Crestline Investors is at the forefront of this transformation. With a robust portfolio that spans private equity, direct lending, and real estate, they offer a comprehensive suite of financial services. Their strategies are designed to provide liquidity solutions and capital solutions that can empower influencers to expand their reach and impact.

For influencers, understanding the dynamics of investment management and capital solutions is crucial. It opens up opportunities to collaborate with financial analysts and managing directors who can offer insights into fund liquidity and alternative investment strategies. This collaboration can lead to innovative solutions that enhance an influencer's ability to navigate the complex world of social media influence.

As the role of financial services in social media continues to grow, influencers must adapt to this new reality. By aligning with investors like Crestline, they can tap into a wealth of resources that can help them scale their influence and achieve their goals. For those looking to elevate their influence amongst professionals, exploring platforms like LinkedIn can be a strategic move. Harnessing LinkedIn's B2B landscape can provide influencers with the tools they need to succeed in a financially driven environment.

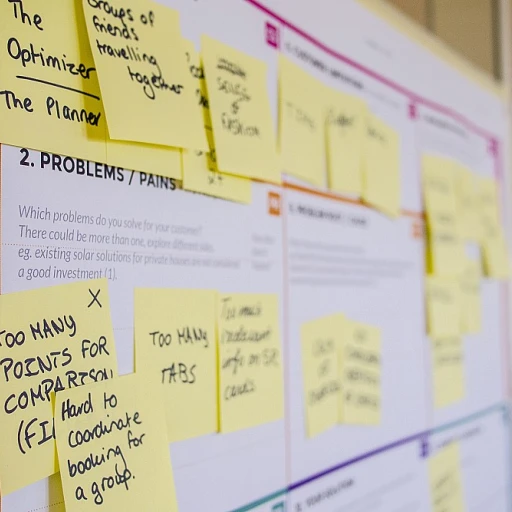

Challenges Faced by Influencers in a Financially Driven Environment

Navigating Financial Complexities

In the world of social media, influencers often face unique challenges when operating in a financially driven environment. With the rise of investment firms like Crestline Investors, influencers are increasingly encountering the complexities of finance, which can impact their strategies and growth potential.

Balancing Creativity and Financial Expectations

One of the primary challenges is balancing creative freedom with the expectations of investors. Influencers must navigate the demands of maintaining their authentic voice while meeting the financial goals set by investors. This can be particularly challenging when investors, such as those from Crestline, have specific objectives related to capital management and return on investment.

Understanding Financial Jargon

Influencers often need to familiarize themselves with financial terminology and concepts, such as NAV financing, fund liquidity, and direct lending. This knowledge is crucial for effectively communicating with investors and understanding the implications of investment decisions on their personal brand and content strategy.

Managing Investor Relationships

Building and maintaining relationships with investors requires a strategic approach. Influencers must be adept at managing expectations and demonstrating the value of their influence in terms of financial returns. This involves not only showcasing their reach and engagement but also understanding the broader investment landscape, including private equity and alternative investment strategies.

Adapting to a Financially Driven Market

As the influence of financial services grows, influencers need to adapt their strategies to align with the goals of investors. This may involve exploring new content formats or platforms that resonate with investor interests, such as real estate or investment banking topics. For those looking to enhance their professional presence, mastering platforms like LinkedIn can be particularly beneficial. For more insights, check out this guide to building your professional presence.

Opportunities for Influencers with Financial Backing

Leveraging Financial Support for Enhanced Influence

In today's dynamic digital landscape, the union of financial resources and social media influence offers an unprecedented opportunity for growth and expansion. As influencers navigate this space, they can capitalize on the robust financial backing provided by entities like Crestline Investors to amplify their reach and impact.

Firstly, financial backing opens doors to an enriched content production process. With access to capital, influencers can invest in high-quality production equipment, professional editing services, and strategic marketing campaigns. This not only elevates the quality of content but ensures it reaches a wider and more engaged audience.

- Expanded Content Creation: With the capability to hire experienced professionals, influencers can expand their creative horizons, producing diverse types of content such as podcasts, webinars, or immersive video series.

- Strategic Partnerships: Backed by investment, influencers can forge alliances with other content creators and brands, creating mutually beneficial collaborations that resonate with their audience.

- Targeted Marketing Efforts: Influencers can allocate funds towards precision-targeted advertising on social media platforms, enhancing visibility and engagement.

Secondly, the alignment with financial entities like Crestline enables influencers to access specialized financial expertise. This includes advice on portfolio management, direct lending, and alternative investment, which can significantly impact their business operations and decision-making processes.

Finally, having an investment management firm in their corner allows influencers to explore alternative revenue streams. From nav financing to fund liquidity solutions, the potential diversification of income sources ensures financial stability, even in a fluctuating economic environment.

Discover more about how strategic investment from organizations like Crestline Investors can revolutionize your influence on social media. Understanding the interplay between finance and social media is critical for those seeking to harness financial backing effectively.

Case Studies: Successful Collaborations with Crestline Investors

Real-Life Examples of Success

In exploring the intersection between social media influencers and the financial capabilities of Crestline Investors, the instances of successful partnerships shine a light on the potential of this collaboration. These real-world examples stand as a testament to the promising and potent fusion of financial expertise with social media reach.- Direct Lending Ventures: Influencers with a niche focus on financial services were able to collaborate directly with Crestline in promoting their lending fund strategies. This involved content creation that was not only informative but actively promoted engagement with Crestline’s capital solutions.

- Portfolio Expansion: By leveraging the investment management prowess of Crestline, influencers in business and investment sectors could align their content with Crestline's private equity goals. Such collaboration enabled these influencers to expand their content portfolios with substantial backing.

- Financial Education Initiatives: A group of influencers partnered with Crestline to develop a series of educational initiatives about investment banking and NAV financing. These projects not only enhanced the public’s understanding but also increased the influencers’ credibility and reach.

- Innovative Real Estate Content: With real estate being a strategic focus for many financial entities in Fort Worth, influencers collaborated with Crestline to create innovative content around real estate investment strategies. These projects promoted the idea of secure investment through credible sources.

Strategies for Influencers to Attract Financial Investment

Appealing to Financial Investors: Key Strategies

For social media influencers looking to bolster their projects with financial backing, understanding what appeals to investors is crucial. The world of investment is deep-rooted in financial expertise, strategic planning, and generating returns, making it vital for influencers to align their goals with these facets.

Highlight Robust Engagement Metrics

Investors from firms like Crestline prioritize tangible outcomes. When approaching potential backers, showcasing clear, robust engagement metrics can significantly bolster an influencer's proposition. Consider presenting detailed statistics that demonstrate audience growth, interaction rates, and overall community engagement. This data portrays a strong, active presence that investors find attractive.

Develop a Unique Value Proposition

One of the primary tasks for influencers is to craft a unique value proposition. How does your platform differ from others? What distinct talent or perspective do you bring that aligns with a company's goals? By defining your niche, you not only attract a dedicated audience but also position yourself as a worthwhile investment. A well-articulated value proposition can make your partnership offer more compelling to investment management firms.

Network with Financial Professionals

Building relationships with individuals in financial positions can open doors for influencers. Engaging with analysts, managing directors, and those in alternative investment sectors can lead to insightful perspectives on how to tailor your strategy to attract investment. Additionally, attending industry events in places like Fort Worth, Texas or influential financial hubs across North America can expand your network and understanding of the landscape.

Align Content with Financial Themes

Infusing financial themes into your content can create relatability and relevance, increasing your allure to prospective investors. Whether it's through a focus on investment banking, private equity, or capital solutions, demonstrating an understanding or interest in these areas can be beneficial. However, authenticity is critical, so ensure any financial content remains true to your voice and style.

Leverage Existing Collaborations

Lastly, showcasing previous successful collaborations, even with non-financial partners, can demonstrate your capability to deliver results and work effectively with brands. This track record can provide comfort to investors and justify why your initiatives are worth their capital.