Understanding Internal Investment Ventures

Decoding the Dynamics of Internal Investment Ventures

Navigating the landscape of social media influence is no small feat. For influencers aiming to expand their reach and impact, understanding the mechanisms behind internal investment ventures is essential. These ventures represent a strategic approach to harnessing opportunities within a company, unlike external ventures that typically involve partnerships with external entities.

Internal ventures are pivotal as they allow influencers and companies to rally resources in an environment that encourages innovation and creative exploration. By aligning with a parent company's goals, such ventures can streamline cash flows, offering financial support that can ultimately diversify the parent company’s portfolio. Over time, this fosters a stable and proactive ecosystem for growth while still retaining an edge in the ever-evolving social media market.

Corporate venture capitalists are continuously seeking investments in early-stage projects, leading to potential joint ventures that could revolutionize the influencer business model. These capital funds are crucial for fueling creativity and facilitating the growth of a personal brand through innovative approaches.

Delving into these complexities also brings about the need for influencers to integrate effective financial strategies to manage long-term and short-term risks. Understanding the balance between financial viability and creative authenticity will prepare influencers to maximize the benefits from their internal venture endeavors.

The Role of Personal Branding

Maximizing Your Personal Brand in Social Media Influence

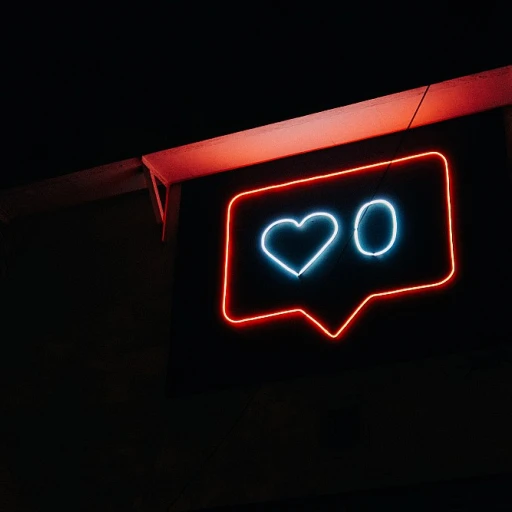

In the ever-evolving social media landscape, personal branding has become a pivotal element for influencers looking to capitalize on their internal investment ventures. Establishing a strong personal brand allows influencers to stand out in a competitive market, acting as a unique selling point that attracts venture capital interest. Personal branding is more than just a recognizable name or face; it's about conveying a consistent message and values that resonate with a specific audience. This is crucial for building trust and credibility, integral factors that venture capitalists and corporate venture firms consider when evaluating potential investments. A successful personal brand can become a powerful strategy, one that not only attracts brands and companies looking for partnerships but also positions an influencer as an industry leader. This leadership role can increase an influencer's worth in the market and enhance their ability to secure capital funds and private equity from internal ventures. For influencers, personal branding also plays a key role in long-term strategy. It’s not just about immediate cash flows but about creating a sustainable roadmap that includes potential ventures and partnerships. Those who carefully cultivate their brand can tap into other opportunities such as joint ventures or collaborations with startups and portfolio companies, thus expanding their influence beyond traditional social media boundaries. Additionally, building a well-recognized personal brand can help influencers navigate their monetizing efforts effectively. This aligns with the broader theme of exploring navigating the complex world of secondary advisory in social media influence, as a strong personal brand can significantly enhance the potential for secondary business collaborations and investments. In a world where innovation and strategic capital funds play an increasingly significant role, influencers must focus on solidifying their personal brand to not only attract financial investments but also maintain their authenticity.Monetizing Content Creation

Strategies for Maximizing Content Revenue

Monetizing content creation is a cornerstone of thriving in social media influence. As influencers, understanding and employing different investment strategies can provide a steady stream of revenue. Venturing into the corporate world can translate your audience engagement into tangible financial growth. Here are some pathways you can explore:- Partner with corporate ventures: Collaborate with companies looking to enhance their reach by tapping into your established audience. Such alliances can create mutually beneficial opportunities for both parties.

- Diversify investment portfolios: Consider allocating profits into venture funds or partnering on new innovative projects. Venturing into different markets provides security and the potential for significant returns.

- Create joint ventures: Establish symbiotic relationships with other influencers or companies where resources are pooled for larger, more impactful campaigns.

- Explore capital funds: Engage with venture capital firms that focus on social media and content ventures. These entities often seek influencers to invest in or represent their interests.

Building a Supportive Network

Fostering a Collaborative Environment

Building a supportive network is crucial for influencers looking to thrive in the competitive landscape of social media. This network acts as a backbone, providing not only emotional support but also strategic insights that can propel an influencer's career forward. In the realm of internal investment ventures, having a robust network can be the difference between success and stagnation.

For influencers, connecting with other creators, venture capitalists, and corporate venture firms can open doors to new opportunities. These relationships can lead to joint ventures, where influencers collaborate with companies to create innovative content that resonates with their audience. Such collaborations often result in increased visibility and access to capital funds, which are essential for scaling operations.

Strategic Partnerships and Alliances

Strategic partnerships with early-stage startups or established firms can also be beneficial. These alliances allow influencers to tap into new markets and diversify their content offerings. By aligning with companies that share similar values, influencers can maintain authenticity while exploring new avenues for growth. This balance is crucial, as it ensures that the influencer's brand remains genuine, even as they pursue commercial interests.

Moreover, influencers can leverage their network to gain insights into market trends and financial strategies. Engaging with venture capitalists and private equity firms provides a deeper understanding of fund performance and investment strategies, which can be invaluable when planning long-term business goals. This knowledge empowers influencers to make informed decisions about their content and investment ventures.

Creating a Sustainable Ecosystem

Ultimately, building a supportive network is about creating a sustainable ecosystem where influencers, companies, and venture capitalists can thrive together. By fostering a culture of collaboration and innovation, influencers can ensure their ventures remain relevant and impactful in the ever-evolving social media landscape. This approach not only enhances their personal brand but also contributes to the broader community, paving the way for future influencers to succeed.

Leveraging Analytics for Growth

Harnessing Data-Driven Insights for Strategic Growth

In today's ever-evolving digital landscape, influencers are increasingly turning towards data analytics to fuel their internal investment ventures. This strategic use of analytics empowers influencers to understand and anticipate market trends, ultimately guiding their financial investment strategies. Whether you're seeking to develop a successful venture capital portfolio or looking to diversify investment channels, analytics provide the key to unlocking potential financial opportunities.

Leveraging analytics isn't just about collecting data; it's about translating numbers into actionable insights. For influencers, this means identifying which content resonates best with audiences, resulting in higher engagement and better monetization of their creations. Accurate data interpretation can help influencers identify lucrative opportunities in their investment ventures by highlighting trends in startups and innovation within the corporate sector.

Here’s how influencers are using analytics to support their financial strategies:

- Investment Tracking: By closely monitoring engagement metrics, influencers can determine the success of their investment portfolio, adjusting their strategies in alignment with corporate venture trends.

- Audience Insights: Understanding audience preferences and behaviors allows influencers to tailor their content creation strategies for maximum impact, ensuring enhanced profitability through well-targeted content.

- Market Prediction: Analyzing data patterns helps predict market movements, providing influencers with the confidence to make informed decisions about long-term ventures and potential joint ventures.

In a landscape where financial success often depends on the ability to adapt and innovate, influencers with a strong grasp of analytics will find themselves ahead of the curve, equipped to seize the best opportunities in both internal and external ventures.

Balancing Authenticity and Commercial Interests

Balancing Genuine Influence and Financial Gains

The dynamic landscape of social media requires influencers to strike a harmonious balance between authenticity and commercial partnerships. Balancing authenticity with business interests is essential for maintaining credibility while exploring internal investment ventures, such as corporate venture capital (CVC), corporate venturing, and collaborations with capital firms.

When influencers align themselves with corporate investments or become part of a venture capital fund strategy, they must ensure that their content remains genuine and trustworthy. The audience, the bedrock of social media influence, values authenticity over overt promotions. Melding personal branding with corporate interests involves using a strategy that resonates with both personal values and market trends.

Monetizing content creation requires a fine-tuned approach where financial goals meet audience expectations. When pursuing financial opportunities, whether through private equity ventures or eternal collaborations, influencers must be transparent with followers. Building trust in this way cultivates a supportive network that values the influencer's expertise and authenticity.

Utilizing analytics can provide insights into audience preferences and content performance, enabling influencers to adapt their strategies effectively. By analyzing data, influencers can identify how best to negotiate the intersection between authenticity and investment benefits. Experimenting with analytics-driven strategies ensures sustained growth while respecting the audience's desire for organic interactions.

Success in balancing these interests not only requires adeptness in content creation but also a strategic overview akin to the operations seen in corporate venture funds. It's about crafting a narrative where business and creativity coexist, much like joint ventures in the corporate world, where the ultimate goal is long-term engagement and business growth.