Understanding the Role of Influencers in Private Equity

The Influence of Social Media in Private Equity

The role of influencers has become increasingly significant in private equity, where outreach and engagement can make a real difference in attracting co-investors. With the right strategy, influencers help bridge the gap between potential partners and firms, ensuring investments are not only effective but also aligned with the growth plans of private companies.

In the fast-paced world of private equity investments, influencers wield their power to guide investment decisions, particularly in niche segments where specialized knowledge and credibility are necessary. The ability to build trust and authority through regular and insightful content on various platforms makes them valuable assets in this field.

Given the varied nature of equity funds, influencers utilize their expertise to inform both new and seasoned investors, whether they are high-net-worth individuals or part of large equity firms. This guidance is crucial as firms operate in multiple areas such as buyout, venture capital, and growth equity, ensuring that investment decisions are well-informed and beneficial to portfolio companies.

As private firms seek to attract more capital, the influence of seasoned professionals becomes indispensable. These influencers are often well-versed in a range of investment types, from hedge funds to real estate, aligning with the objective of securing long-term growth and minimizing risks. As such, their endorsement can impact how funds are perceived in the market, encouraging co-investors to come on board with reduced hesitation.

Building a Strong Personal Brand

Developing a Compelling Personal Brand for Private Equity Success

Creating a personal brand that resonates within the private equity industry is essential for attracting co-investors. It's more than just crafting a professional image; it's about building a brand that communicates your unique value proposition. This forms a cornerstone in establishing credibility and gaining trust among potential partners. A solid personal brand serves as a multifaceted asset for capital-raising efforts. It informs your potential investors—whether limited partners, high net worth individuals, or fund managers—about your expertise and track record in managing successful equity investments.- Authenticity is Key: Be genuine in your approach. Share real experiences and insights from your career in private equity, whether it involves managing buyouts, portfolio companies, or hedge funds. This fortifies your reputation and makes you relatable to investors.

- Expertise in Your Niche: Focus on areas where you have proven expertise, such as real estate or growth equity. Highlight case studies or successes that demonstrate your proficiency in managing funds and capital over the long term.

- Clarity in Communication: Use clear and concise language to articulate your goals and strategies. Investors are more likely to engage with someone who speaks transparently about their vision and pathways to achieving growth.

Utilizing Social Media Platforms Effectively

Maximizing Social Platforms for Investment Attraction

Pursuing co-investors for your private equity ventures can greatly benefit from an impactful presence on social media channels. As you seek to connect with potential partners or equity firms, understanding how to best utilize these platforms is essential. Here's how you can capitalize on social media to enhance your investment ventures:- Select the Right Platforms: Not all social media platforms are made equal for fund managers. Platforms like LinkedIn and Twitter can provide direct access to industry experts, potential investors, and decision-makers within equity firms. Identifying where your target audience spends their time online can guide your outreach strategy effectively.

- Engage with Educational Content: Providing your followers with insights into the market trends and investment opportunities can establish you as a thought leader. By regularly publishing educational content about growth equity, buyout opportunities, or alternative investments, you create a repository of knowledge that appeals to high net worth individual investors.

- Utilize Multimedia Communication: Videos and podcasts can be powerful tools to discuss private equity strategies, showcase successful portfolio companies, and highlight your management skills. Engaging multimedia content can capture the attention of limited partners more effectively than text-based posts alone.

- Leverage Analytics to Fine-Tune Your Approach: Social media platforms offer a wealth of analytics tools that provide insights into your audience’s engagement patterns. By understanding what content resonates, you can refine your approach to better appeal to potential private companies or capital investors.

- Collaborate with Industry Influencers: Partnering with influencers who have established credibility within the investment community can also broaden your reach. Inviting these individuals for joint discussions or shared content can introduce your equity fund to a wider audience.

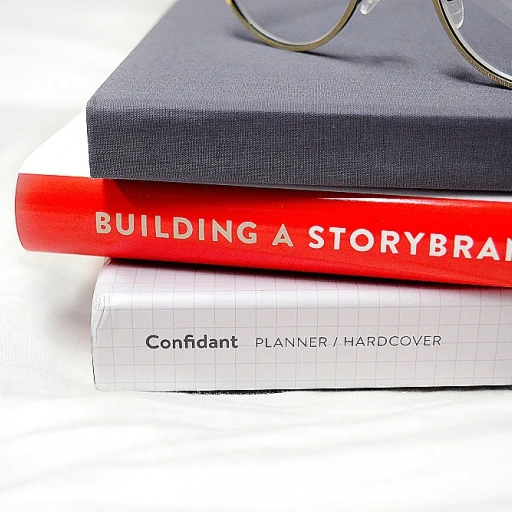

Creating Engaging Content to Attract Investors

Crafting Magnetic Stories to Engage Potential Backers

In the realm of private equity, capturing interest is pivotal. A powerful narrative can distinguish your venture's identity, build trust, and ultimately attract investors to your cause. Creating content that resonates with potential co-investors involves several strategies:- Highlighting Success Stories: Share stories of past successes with tangible outcomes. Discuss how your equity firm or venture capital project led to the growth of portfolio companies or achieved long-term returns. This can help position your business as a leader in investment management.

- Utilizing Data-Driven Insights: Investors value data-backed content. Share insights on market trends, capital growth potential, and investment risk management. Leveraging such information establishes your authority and expertise.

- Illustrating Value Proposition: Clearly articulating how your strategies can generate high net worth returns or benefit individual investors is critical. Discuss fund management strategies, highlighting your approach toward buyout, growth equity, or alternative investments.

- Showcasing Industry Knowledge: Sharing knowledge about private companies and emerging markets fosters credibility. Engage your audience by discussing case studies or analysis of equity funds and venture capital successes.

Networking and Building Relationships Online

Connecting Opportunities Through Online Engagement

Developing relationships online is essential for investors in the realm of private equity. Digital connections can facilitate capital accumulation and foster collaborations. Here's how to effectively cultivate these connections.- Leverage LinkedIn: This platform is invaluable for high net worth individuals and investment professionals. Regular updates showcasing growth and successful buyouts in your portfolio companies can attract equity firms and potential co-investors.

- Participate in Online Forums and Groups: Engage with communities focused on private equity, venture capital, and alternative investments. This is a strategic method for sharing insights and identifying potential partners with mutual interests.

- Engage with Content: Commenting and contributing to discussions on articles about trends in private markets or posts published by investment firms can elevate your visibility and authority in the field.

- Showcase Your Expertise: Publish content that highlights your understanding of the investment landscape. Include insights on equity management, successful fund strategies, and the importance of long-term growth.

- Weekly Newsletters: Keep an engaged audience by disseminating information on market trends, funds updates, or new investment opportunities. This helps to maintain relevance and keep potential investors interested.

Overcoming Challenges in Seeking Co-Investors

Overcoming Hurdles in the Quest for Co-Investors

The journey to secure co-investors for private equity ventures is often laced with numerous challenges. Yet, understanding these obstacles and developing strategies to address them can enhance your chances of attracting potential co-investors.

One of the primary challenges is differentiating your equity firm in a crowded market. With so many equity firms and venture capital entities seeking capital, it is vital to carve out a unique identity that stands out to investors looking to diversify their portfolio. This ties back to the necessity of building a strong personal brand, showcasing your firm’s values, successes, and unique propositions.

Another concern is managing the investor’s perception of risk associated with your company. Providing transparent insights into growth strategies, portfolio companies’ performance, and long-term value can help mitigate perceived risks. Clearly communicate how your fund management strategies align with investor expectations and market trends.

Building trust is also a significant challenge. Equally vital is establishing credibility, especially with high-net-worth individuals and limited partners who are critical to the growth of private equity funds. Regular communication through detailed reports and updates build rapport and trust with these investors.

The availability of alternatives like hedge funds and real estate investments further compounds the challenge. Co-investors may prefer other alternative investments for perceived stability or familiarity. As an influencer, utilizing social media platforms effectively to highlight the unique benefits of your investments can pivot attention back to your equity fund.

Lastly, the importance of perseverance in networking and building relationships online cannot be underscored enough. It requires dedication and strategic engagement with potential investors and capital firms. Understanding the nuances of the online investment community and aligning your approach with their interests will position your business favorably in the private equity venture space.