Understanding moic and its relevance in social media influence

What is MOIC and Why Does It Matter for Influencers?

MOIC, or Multiple on Invested Capital, is a metric often used in private equity and investment circles to measure the total cash returns generated from an initial investment. In simple terms, it tells you how much value you’ve created compared to the capital you started with. For social media influencers, understanding MOIC can help you see your influence as an investment—one that grows over time as you put in effort, creativity, and resources.

When you think about your journey as an influencer, every piece of content, partnership, or campaign is like an investment. The capital invested isn’t just money; it’s also your time, energy, and creativity. MOIC helps you evaluate the performance of these investments by comparing the total cash inflows or returns you’ve realized against your initial capital outlay. This approach is similar to how private equity professionals assess the success of their funds or investments.

Connecting MOIC to Your Social Media Growth

By tracking your own MOIC, you can better understand which strategies or collaborations deliver the highest returns. For example, if you invest in a new camera or spend time learning advanced editing skills, you can measure the impact by looking at the increase in your audience engagement, brand deals, or total realized income. This is where concepts like IRR (Internal Rate of Return) and TVPI (Total Value to Paid-In) also come into play, helping you assess both the speed and scale of your growth.

- Investment performance: Are your efforts leading to higher returns over time?

- Net MOIC vs. Gross MOIC: Are you considering all costs and not just the top-line results?

- Calculate MOIC: How do you measure the total cash or value generated from your initial investment?

Understanding these metrics isn’t just for financial professionals. Influencers who treat their brand as a business can use MOIC to make smarter decisions, prioritize the right opportunities, and build a sustainable path forward. This mindset will also help you when it comes to building a personal brand and maximizing your online presence. For more on how to elevate your online presence, check out these SEO strategies for influencers.

Building a personal brand through moic

Defining Your Value Through Moic Metrics

Building a personal brand as a social media influencer is about more than just aesthetics or follower counts. It’s about understanding your value, much like investors assess the performance of their investments using metrics like moic (multiple on invested capital). When you approach your brand with the mindset of investment performance, you start to see every piece of content, collaboration, and engagement as part of your total investment in your online presence.

- Initial investment: The time, creativity, and resources you put into your content and community.

- Capital invested: Money spent on equipment, advertising, or professional development.

- Total cash inflows: Earnings from partnerships, sponsored posts, and other monetization streams.

- Moic: The ratio of total cash returns to your initial capital, showing how your efforts translate into tangible results.

By tracking these elements, you can calculate moic and understand your brand’s performance over time. This approach helps you make informed decisions about where to invest your energy and resources for the best returns, similar to how private equity investors assess their portfolio’s net moic or gross moic.

Aligning Brand Storytelling With Investment Principles

Just as investors look for sustainable returns, influencers should focus on building a brand that delivers value over the long term. Authentic storytelling is key. When you share your journey, lessons learned, and the real impact of your work, you create a deeper connection with your audience. This authenticity can increase your realized moic, as loyal followers are more likely to engage, share, and support your projects.

For actionable insights on using storytelling to inspire and grow your brand, check out harnessing the power of brand storytelling. It’s a resource that aligns with the investment mindset, showing how narrative can boost your brand’s rate of return.

Tracking and Adjusting for Sustainable Growth

As you build your brand, regularly review your investment performance. Use metrics like tvpi (total value to paid-in) and irr (internal rate of return) to evaluate both realized and unrealized gains. This ongoing assessment ensures you’re not just investing time and money, but also achieving meaningful returns. Remember, your brand is your fund—treat it with the same diligence as any private equity investment.

Navigating challenges unique to influencers with moic

Overcoming Obstacles When Applying MOIC to Your Influencer Journey

As a social media influencer, understanding MOIC (Multiple on Invested Capital) is more than just a financial metric—it's a lens through which you can evaluate your investment performance and strategic decisions. But integrating MOIC into your workflow comes with unique challenges, especially in the fast-paced world of digital influence.

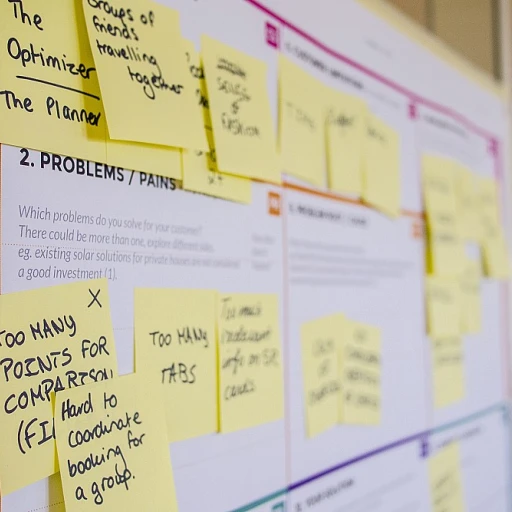

- Translating Financial Metrics to Creative Work: Unlike traditional private equity investments, influencer capital is often intangible—time, creativity, and reputation. Calculating MOIC or IRR (Internal Rate of Return) for these investments can be complex. For example, measuring the total cash inflows from a campaign versus the initial investment of time and resources requires careful tracking and honest self-assessment.

- Balancing Short-Term Gains with Long-Term Value: It's tempting to focus on quick returns, but sustainable growth depends on understanding both realized and unrealized gains. Evaluating your total realized MOIC versus your net MOIC helps you see the bigger picture—how your initial capital and ongoing investments are compounding over time.

- Managing Multiple Revenue Streams: Influencers often juggle brand deals, ad revenue, and private collaborations. Each stream has its own capital invested and return profile. Calculating the performance of each, using metrics like TVPI (Total Value to Paid-In), helps you allocate your efforts for maximum impact.

- Adapting to Market Changes: The influencer landscape shifts rapidly. What worked for your initial investment may not yield the same returns now. Regularly reviewing your investment performance, including gross MOIC and IRR MOIC, ensures you stay agile and responsive to new opportunities.

One often overlooked challenge is understanding how earnings credit rates affect your influencer income. For a deeper dive into this topic, check out this analysis of earnings credit rate impact.

| Investment Metric | What It Means for Influencers |

|---|---|

| MOIC | Measures total cash returns relative to capital invested in content, partnerships, or platforms. |

| IRR | Shows the rate of return on your time and money invested, factoring in the timing of cash inflows. |

| TVPI | Evaluates the total value created, both realized and unrealized, from all your investments. |

By facing these challenges head-on and regularly calculating your MOIC, you can make smarter decisions, optimize your capital allocation, and build a more resilient influencer business.

Creating authentic connections with your audience

Fostering Genuine Engagement Through Investment Principles

Creating authentic connections with your audience as a social media influencer goes beyond just sharing content. It’s about treating your relationship with followers like an investment. Just as private equity professionals evaluate the performance of their capital, influencers should assess the value they bring to their community. This approach helps build trust and long-term loyalty.

- Value Exchange: Think of your time and energy as your initial capital. Every post, story, or comment is an investment in your audience. The total returns come in the form of engagement, loyalty, and influence.

- Transparency: Just as investors expect clear reporting on invested capital and realized returns, your followers appreciate honesty. Share your journey, including both successes and challenges, to foster a sense of authenticity.

- Consistency: Regular, high-quality content is like consistent cash inflows in private equity. It keeps your audience engaged and strengthens your brand’s performance over time.

Applying MOIC Metrics to Audience Relationships

MOIC (Multiple on Invested Capital) isn’t just a financial metric—it’s a mindset. Influencers can use the concept to measure the impact of their efforts. For example, consider the total cash (engagement, shares, comments) you receive relative to your initial investment (content creation, time, resources). This helps you understand your return on investment and guides future strategies.

| Influencer Investment | Audience Return | MOIC Perspective |

|---|---|---|

| Time spent creating content | Comments, shares, likes | Multiple invested capital |

| Initial capital (resources, creativity) | Growth in followers, brand collaborations | Total realized MOIC |

| Consistent engagement | Community loyalty, repeat interactions | Net MOIC over time |

By adopting this investment performance mindset, you can calculate your own MOIC and IRR (internal rate of return) in terms of influence. This helps you focus on what delivers the highest returns—authenticity, transparency, and consistent value. Over time, these principles will help you build a sustainable, high-performing presence in the social media landscape.

Leveraging moic for sustainable growth

Turning Your Unique Value into Lasting Influence

As a social media influencer, leveraging your moic is about more than just numbers. It’s about treating your influence as an investment, where your initial capital is the unique value you bring to your audience. Just like in private equity, your goal is to maximize your total returns over time, not just chase quick wins.

- Think like an investor: Each post, collaboration, or campaign is a form of capital invested. Consider the long-term performance, not just immediate cash inflows.

- Measure your returns: Track your total realized value, including engagement, brand partnerships, and audience growth. Calculate your moic (multiple on invested capital) to see how your initial investment in content creation is paying off.

- Balance short-term and long-term gains: While some investments yield quick returns, others—like building trust—take time but deliver higher net moic and irr (internal rate of return) in the long run.

- Reinvest in your brand: Use the total cash and performance data from your past investments to inform future strategies. This could mean refining your content, exploring new platforms, or deepening audience connections.

For influencers, sustainable growth comes from understanding the relationship between capital invested and total investment performance. By focusing on both realized moic and potential future returns, you can ensure your influence continues to grow and evolve. Remember, your audience is your most valuable asset—invest in them wisely, and the returns will follow.

Measuring the impact of moic on your influence

Key Metrics for Tracking Your Influence

To truly understand the impact of moic on your journey as a social media influencer, it’s essential to measure your performance using clear, actionable metrics. Just as private equity professionals analyze investment performance with terms like moic, irr, and tvpi, influencers can apply similar concepts to assess their growth and returns over time.

- Moic (Multiple on Invested Capital): This measures the total cash returns generated compared to your initial capital invested in your content, campaigns, or brand-building activities. For example, if you invest $1,000 in content creation and realize $3,000 in total cash inflows, your moic is 3.0.

- IRR (Internal Rate of Return): IRR tracks the rate of return on your investments over time, factoring in the timing of cash inflows and outflows. This helps you understand not just how much you’ve earned, but how quickly your investments are paying off.

- TVPI (Total Value to Paid-In): TVPI combines both realized and unrealized returns, giving you a holistic view of your total investment performance. For influencers, this could mean combining actual earnings with the value of ongoing partnerships or brand equity.

Applying Private Equity Metrics to Social Media Influence

Think of your time, energy, and money as capital invested in your brand. By tracking your net moic, gross moic, and realized moic, you can see which strategies deliver the best returns. For example, if a particular campaign yields a higher multiple on invested capital than others, it’s a sign to double down on similar efforts.

| Metric | What It Measures | How Influencers Use It |

|---|---|---|

| Moic | Total cash returns / Initial investment | Compare total realized earnings to capital invested in content or ads |

| IRR | Annualized rate of return | Assess how quickly your investments generate returns |

| TVPI | Total value (realized + unrealized) / Total invested capital | Evaluate both cash earnings and ongoing brand value |

Practical Steps to Calculate and Improve Your Moic

- Track every dollar and hour invested in your content, partnerships, and marketing.

- Calculate your moic regularly by dividing total cash returns by your initial capital invested.

- Analyze which investments yield the highest returns, and adjust your strategy accordingly.

- Use IRR to understand the rate of return on your investments over time, not just the total amount earned.

By adopting these investment performance metrics, you can make more informed decisions, optimize your strategies, and ensure your influence grows sustainably. Remember, measuring your returns isn’t just about money—it’s about maximizing the value of your time, creativity, and capital invested in your unique path as an influencer.